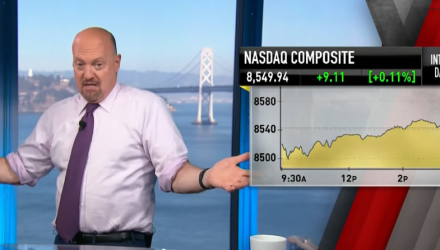

Technology is such a strong component in today’s business landscape that rather than be an ancillary part of a company, it can make or break it. CNBC’s “Mad Money” host Jim Cramer says it’s the foundation of great businesses, and investors can take part via technology-focused ETFs.

Much talk in the capital markets right now is that value-oriented equity plays are in favor as opposed to growth-oriented, momentum-based and technology-heavy equities. However, ETF investors can’t simply dismiss these tech-focused funds whether the extended bull market is beginning to wane or not.

“Tech is how good businesses become great ones. It’s how they take themselves to the next level, and I want to show you how that works,” Cramer said. “When you focus on the technology that’s changing the world, it reminds you that when tech stocks go down they’re not necessarily out,”

Cramer cited semiconductor companies like AMD and Nvidia, which were sensitive to the U.S.-China trade war news. Nonetheless, the company fundamentals of these tech companies outweigh the market noise like trade news.

“The stocks were reacting to the charts, to the chatter, to the oh-so-slight revisions on one or two lines of gibberish that control absolutely nothing,” Cramer said. “I wasn’t worried about AMD or Nvidia … because I came out here regularly so I know how indispensable their chips have become to the modern world.”

“In that case, it’s crazy to sell these stocks when they report good quarters with a tiny bit of irrelevant hair on them,” Cramer added. “Nobody will remember that fly in the ointment a week later.”

Getting Broad Tech Exposure via ETFs

For investors looking to broad tech exposure, there’s the Technology Select Sector SPDR ETF (NYSEArca: XLK). XLK tries to reflect the performance of the Technology Select Sector Index, which is comprised of technology and telecom sector of the S&P 500. The ETF includes companies from technology hardware, storage, and peripherals; software; diversified telecommunication services; communications equipment; semiconductors and semiconductor equipment; internet software and services; IT services; electronic equipment, instruments and components; and wireless telecommunication services.

Another option is the Fidelity MSCI Information Technology Index ETF (FTEC). The fund tries to reflect the performance of the Nasdaq-100 Technology Sector Index, which consists of companies in the Nasdaq-100 Index classified as technology according to the Industry Classification Benchmark. QTEC currently holds 34 components and more-or-less equally weights its holdings.

For more investment trends, visit ETFTrends.com.