By RiverFront Investment Group

As the US economy continues its expansion of more than 10 years, it is natural for investors to start wondering when the next recession will happen. In fact, whenever this next recession starts, it might be the most widely anticipated slowdown in US history! With US stocks being near record highs, we’ve encountered many skeptical investors that are still waiting to invest their cash until a better entry point presents itself.

To be fair, there is no shortage of scary catalysts that could derail the US expansion. As we noted in our September 30, 2019 Weekly View, the potential for impeachment, Brexit, tensions in the Middle East, and a full-blown trade war with China could all trigger a slowdown for the US economy and pressure an investment portfolio. The risk of these negative events raises questions like, “is now a good time to buy stocks” or “should I wait for a pullback before investing?”

This week, we’d like to take a step back from our tactical views and reinforce the benefits of being a long-term investor and sticking with a financial plan that has been tailored to meet specific investment goals. More specifically, we’d like to focus on investor psychology, which we think may be even more impactful to long-term returns than any of the data we usually write about.

It is almost always scary to invest. Throughout most of the last 100 years, generally speaking, we think it hasn’t paid for long-term investors to be pessimistic (holding cash/bonds instead of stocks). In the 1970s, the US economy was plagued by two energy crises and double-digit inflation. It became so extreme for investors, that by 1979, a famous headline in BusinessWeek, pronounced the “Death of Equities.” In the 1980s, two recessions gripped the US economy and unemployment spiked over 10%, which didn’t stoke any excitement for stock investors, and yet a major bull market began in 1982. In another example, for years following the Great Recession of 2008, our experience was that some investors were convinced the rally would be short-lived and by staying in cash failed to benefit from any potential excess returns offered by stocks.

We live in a world where financial news is broadcasted 24/7, whether on the television or any of the other forms of media that have emerged. Because of this, the negative catalysts and fear of loss is magnified, making it less likely for it to ever feel safe to invest.

And for the rare times that investing doesn’t seem scary, look out below! In the late 90s when technology seemed to be changing the world, it felt like everybody was buying stocks and making money. However, we all know that eventually the tech bubble burst and reminded investors that there is a price to pay for excessive risk-taking and extreme optimism. In our view, today most equity investors are still cautious and have very subdued expectations for future stock returns…and that’s good news!

With low interest rates, it is expensive to hold cash. Money market instruments are currently paying a little less than 2%, but that could continue to fall if the Fed cuts interest rates further, which we expect them to do at the end of October. Meanwhile, with inflation around 2%, cash on the sidelines barely breaks even. We believe investors should continuously weigh the risks of losing purchasing power in addition to the risk of losing principal.

As an investor’s time horizon increases, the importance of market timing decreases, in our view. Historically speaking, stocks (measured by the S&P 500) have outperformed bonds and cash over longer time periods. However, there is no free lunch and there is a price to be paid for the potential extra returns. While stocks can generate higher returns than bonds over time, with those returns come greater risk and inherent volatility.

The old Wall Street adage that successful investing is not about “timing” but about “time in” rings true for most long-term investors for two reasons. First, over long-time horizons, the US stock market has always eventually recovered its losses, as evidenced this year with the S&P 500 and the Dow Jones Industrial Average hitting new all-time highs. Second, long-term strategies give the investor the benefit of experiencing one of the most powerful forces in the universe, according to Albert Einstein: compound interest.

Working with a trusted advisor can help. We believe that with a long-term financial plan, the daily/weekly headlines can become less scary. There is a popular saying that humans are genetically hardwired to fail at investing. In fact, this reality has become so well-known that an entire field, behavioral finance, has been started to better understand the impact of human emotions on investment decisions.

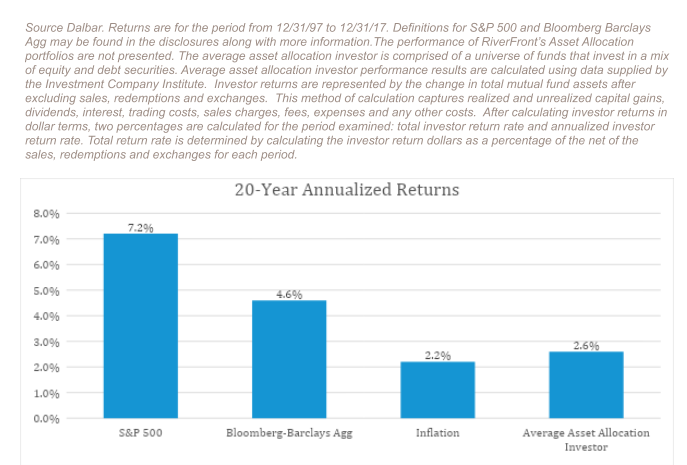

According to Dalbar, over the 20-year period from 1997-2017, US stocks (S&P 500) and US Bonds (Bloomberg Barclays Aggregate) have returned 7.2% and 4.6%, respectively. However, returns for the “average asset allocation investor” were only 2.6%. We believe that investors can avoid many of the behavioral pitfalls that hurt returns by combining a sound financial plan with a rigorous investment process.

As shown above, investor biases are very tough to overcome without a disciplined process. By working with a financial advisor, there are systematic ways to get idle cash back into the market over time, such as a process called “dollar-cost averaging.”

However, there is no single prescription for everyone. For investors focused on long-term growth, especially those that are automatically adding to their investment account, we think its better to get started now and not worry about timing the market or waiting for the next pullback. For investors with shorter-time horizons and income needs, there is a place for fixed income and other diversifiers away from equity to help lower volatility in the event of a downturn.

Bottom Line:

Our comments above speak to the general performance of the markets. An investment strategy, however, needs to be tailored to the unique goals of the individual while properly balancing the relevant risks and rewards. In our opinion, the goal of a long-term investor should be to get invested as soon as possible, thus giving compound interest the opportunity to work for the longest period. We believe that the market can continue climbing the “wall of worry” and that the next significant drawdown might happen at much higher levels. So even though we’re convinced that there will eventually be a pullback, it might not present an entry price that is any lower than today. From this perspective, we believe long-term investors should be more troubled by missing market upside, than avoiding some temporary downside.

We think Headlines Could Use A Warning Label, and don’t believe investors should approach the stock market with fear and trepidation. Instead, remember that volatility is the price to be paid for extra returns. Although it sounds simple, its not an easy thing to do, especially if doing it alone. For these reasons, we recommend working with a financial advisor that can build a customized plan for achieving investment goals over time.

Important Disclosure Information

The comments above refer generally to financial markets and not RiverFront portfolios or any related performance. The indices discussed are for illustrative purposes only and do not cover every investment scenario that an investor may have experienced during the time periods discussed. Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Information or data shown or used in this material is for illustrative purposes only and was received from sources believed to be reliable, but accuracy is not guaranteed.

Dollar cost averaging takes a fixed amount of cash and invests it back into the market over pre-defined time intervals, with the goal of reducing the impact of volatility on large purchases.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

Inflation: a general increase in prices and fall in the purchasing value of money

Stocks represent partial ownership of a corporation. If the corporation does well, its value increases, and investors share in the appreciation. However, if it goes bankrupt, or performs poorly, investors can lose their entire initial investment (i.e., the stock price can go to zero). Bonds represent a loan made by an investor to a corporation or government. As such, the investor gets a guaranteed interest rate for a specific period of time and expects to get their original investment back at the end of that time period, along with the interest earned. Investment risk is repayment of the principal (amount invested). In the event of a bankruptcy or other corporate disruption, bonds are senior to stocks. Investors should be aware of these differences prior to investing. In a rising interest rate environment, the value of fixed-income securities generally declines.

Index Definitions: It is impossible to invest directly in an index. Standard & Poor’s (S&P) 500 Index measures the performance of 500 large cap stocks, which together represent about 80% of the total US equities market. Bloomberg Barclays US Aggregate Bond Index TR USD (Fixed Income Investment Grade) is an unmanaged index that covers the investment grade fixed rate bond market with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities. The issues must be rated investment grade, be publicly traded, and meet certain maturity and issue size requirements. Dow Jones Industrial Average Index — measures the stock performance of thirty leading blue-chip U.S. companies.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply any level of skill or expertise. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations.

RiverFront is owned primarily by its employees through RiverFront Investment Holding Group, LLC, the holding company for RiverFront. Baird Financial Corporation (BFC) is a minority owner of RiverFront Investment Holding Group, LLC and therefore an indirect owner of RiverFront. BFC is the parent company of Robert W. Baird & Co. Incorporated (“Baird”), a registered broker/dealer and investment adviser.

Copyright ©2019 RiverFront Investment Group. All Rights Reserved. 974129