The U.S.-China trade impasse heavily discounted a lot of U.S. equities during the month of May, but it also put the red tag sale on emerging markets (EM). Funds like the Emerging Markets Internet & Ecommerce ETF (NYSEArca: EMQQ) have rebounded from May’s volatility to continue its stellar performance this year.

Combine the tariff battles with a cautious U.S. Federal Reserve set to cut interest rates, and it puts the EM space at an attractive valuation relative to its peers.In addition to broad-based exposure, exchange-traded funds (ETF) to consider also include those in EM that focus on specific sectors like technology.

“The Emerging Market Internet & Ecommerce ETF (EMQQ) has posted strong returns for the year-to-date ending 6/30/19 period (+19.41% NAV & +20.14% Market Price), albeit in a volatile market,” the fund noted in an email. “Coming off a significant drawdown in 2018 that coincided tightly with the announcement and escalation of tariffs between the U.S. and China, the fund has managed to rebound in 2019.”

While most investors might have been driven away by the losses in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue in 2019.

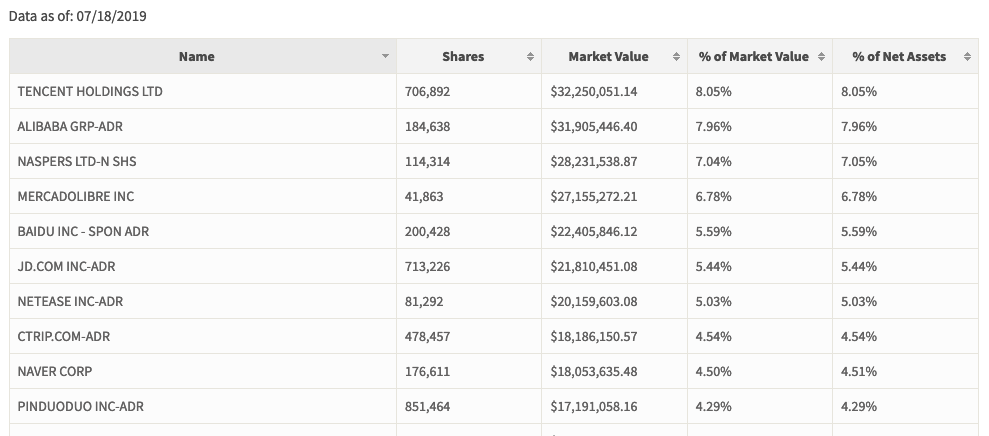

EMQQ invests in companies with exposure to the ecommerce and Internet sectors in emerging markets. Purchasing EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increases their utilization of the Internet and ECommerce.

Despite headwinds from increasingly negative rhetoric, the internet & ecommerce companies represented in EMQQ have continued to post positive fundamental growth with an average annual revenue growth rate of over 35% for the past nine years ending 2018, resulting in significant multiple contraction.

Thus far, EMQQ is up over 25 percent this year, according to Yahoo! Finance performance numbers. Looking at the YTD chart, EMQQ was successfully able to rebound from May and move past its 200-day moving average.

Leveraged Opportunities in EM

For traders, leveraged opportunities within EM can be utilized with the Direxion Daily MSCI Emerging Markets Bull 3X Shares (NYSEArca: EDC) ETF. EDC seeks daily investment results, before fees and expenses, of 300 percent of the daily performance of the MSCI Emerging Markets Index.

The fund invests at least 80 percent of its net assets in financial instruments, such as swap agreements, and securities of the index, ETFs that track the index and other financial instruments that provide daily leveraged exposure to the index or ETFs that track the index. The index is designed to represent the performance of large- and mid-capitalizations securities across 24 emerging market countries.

For more market trends, visit the Leveraged & Inverse Channel.