In last week’s TETF.index update, we looked at how, despite significant inflows, the revenue attributed to ETF sponsors declined by over 9% in 2018. That said, 2019 is off to a great start with more than $8 billion in net flows already and 3.94% YTD increase in assets as of January 11th.

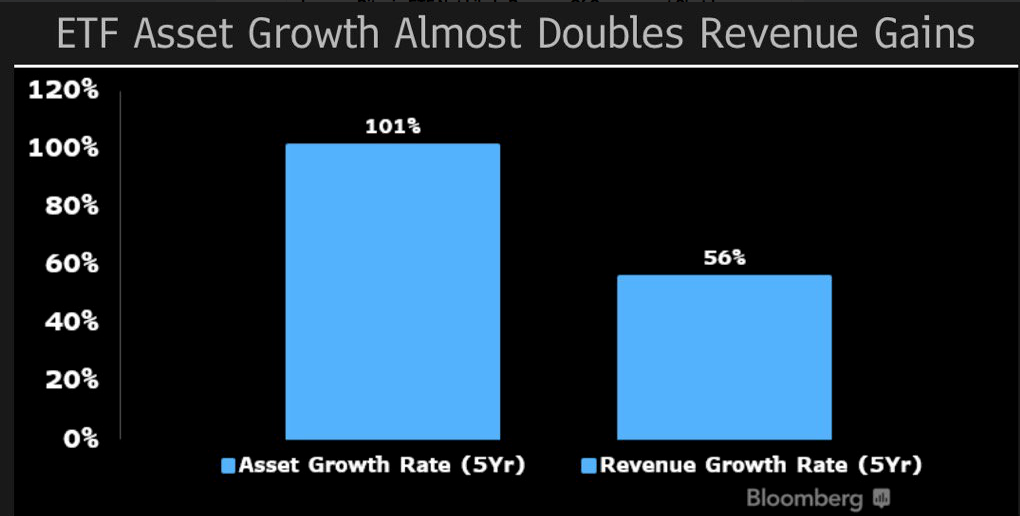

ETF asset growth continues to grow at over 19% annualized and revenue is growing at half that rate over the past five years as depicted in the chart below from Bloomberg:

Lower Cost/Asset Growth = Win/Win

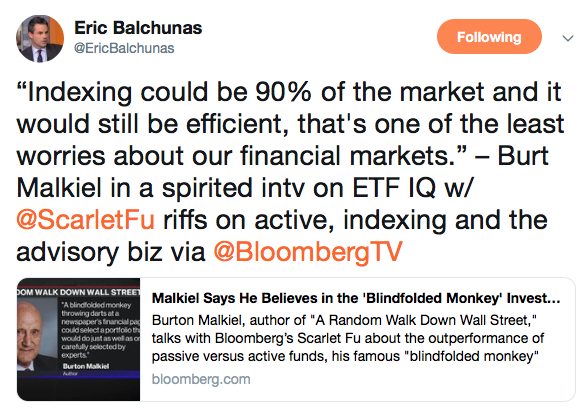

This “win/win” for investors and issuers is the primary client alignment growth factor that will continue to drive ETF asset and revenue growth. This concept was highlighted by TETF.index committee member Burton Malkiel on ETFIQ last week:

The Rising Tides Floats Different Boats

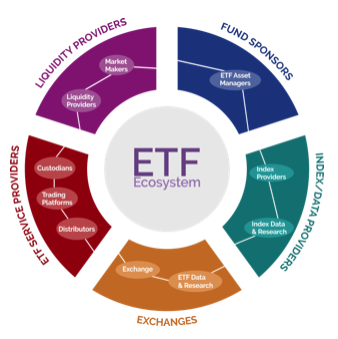

Although 2018 was difficult for issuers from a revenue standpoint, many other ETF ecosystem members benefited from growth in volume and indexing. TETF.index is structured to provide exposure to all the companies participating in ETF growth and ETF issuers make up only about 50% of the index.

As an ETF Nerd exercise in attribution, we looked at equal weighted buckets of each of the five ETF ecosystem companies for 2018. The results are provided in the chart below: