With the holiday season upon us, we’re squarely in the middle of the most critical time of year for retailers. Year-over-year sales growth is always important, but especially so during Q4, as a strong or weak holiday season can often set the tone for the following year and retailers want to show they are growing during the busiest shopping period of the year.

To capitalize on this trade, Direxion has just launched two new ETFs, the Direxion Daily Consumer Discretionary Bull 3X Shares ETF (WANT) and Direxion Daily Consumer Discretionary Bear 3X Shares ETF (PASS). Both aim to deliver 300 percent (or -300 percent) the daily performance of Consumer Discretionary Select Sector Index (IXY).

What makes this trade so interesting is its dependence on the economic landscape and strength of the consumer. Top holdings in the funds like Amazon.com (22.73 percent), Home Depot (10.17 percent), McDonald’s (6.21 percent), Nike (4.70 percent), and Booking Holdings (4.22 percent) are all highly consumer-driven. So with only a few weeks left in the year, it’s worth looking at where the consumer might stand going forward.

The Bull Case

The annual hope for a Santa Claus rally could be in the cards for consumer discretionary should the expected economic growth signals hold strong. One of those economic indicators, monthly retail sales, is expected to come in lower due to declining auto sales. However, retailers like Amazon and Target are expected to have received heavy traffic during post-Thanksgiving holiday shopping. If that’s the case, it bodes well for brands like Nike and Starbucks and the index as a whole, since it’s strong evidence that, in the short term, consumers are still willing and eager to spend, even if not on houses and cars.

The Bear Case

Of course, houses, cars, and other big-ticket purchases are the real bellwethers of economic strength, and it’s likely that the nuance of that retail sales figure could be lost under the anticipated steep decline in auto sales. While that will definitely render a hit against IXY’s General Motors component, the broader implications of consumers’ narrowing buying power could also hit travel names like Bookings. This could be further exacerbated by CPI numbers, due out two days prior on Dec. 12, and the market’s continued uncertainty about a US-China trade deal both putting additional price pressure on the average consumer.

Ultimately, the fate of consumer discretionary will come down to whether the average consumer can afford more. One upcoming release that could tip the scales in either direction is the November wages and employment numbers, expected Dec. 7. Until very recently, wages have failed to show much momentum, and, despite recent 3.5 percent gains, real wages have remained stagnant. This final report for 2018 will show how well the main street U.S. consumer has fared in the background of Wall Street’s gains and could show whether they’ll be able to maintain them through 2019.

The Technicals

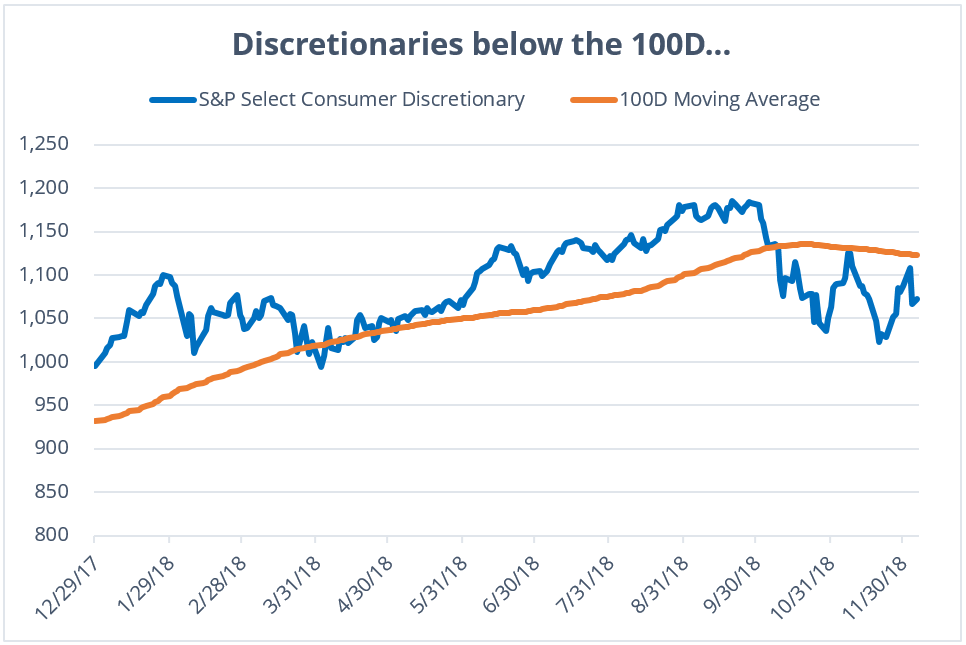

Prices have waned for the consumer discretionary sector, and it is currently trading below the 100-day simple moving average. If momentum returns to this space the next upside target for traders would be to establish a close above its 100D moving average. Upside targets can be magnified with the Direxion Daily Consumer Discretionary Bull 3X Shares ETF (WANT).

Data Range: 12/29/2017 – 12/6/2018. Source: Bloomberg. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate. An investor’s shares, when redeemed, may be worth more or less than their original cost; current performance may be lower or higher than the performance quoted. For standardized performance and the most recent month-end performance, click here.

Related Leveraged ETFs

- Direxion Daily Consumer Discretionary Bull 3X Shares ETF (WANT)

- Direxion Daily Consumer Discretionary Bear 3X Shares ETF (PASS)