A report published by the Joint Center for Housing Studies of Harvard University points to rising interest rates as one of the factors in conjunction with unenthusiastic home buyers as reasons for an anticipated slowdown in the growth of home remodeling.

“Rising mortgage interest rates and flat home sales activity around much of the country are expected to pinch otherwise very strong growth in homeowner remodeling spending moving forward,” says Chris Herbert, Managing Director of the Joint Center for Housing Studies. “Low for-sale inventories are presenting a headwind because home sales tend to spur investments in remodeling and repair both before a sale and in the years following.”

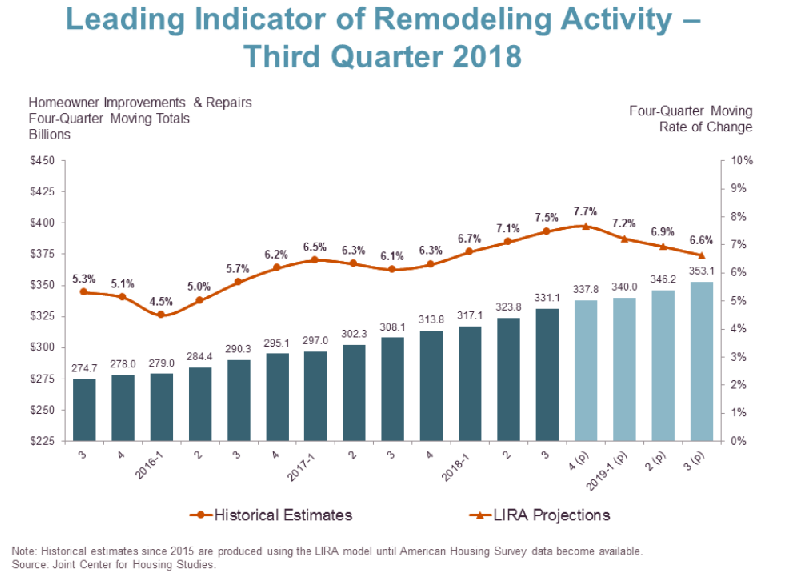

Harvard’s Leading Indicator of Remodeling Activity (LIRA) is used to provide a short-term outlook of national home improvement and repair spending for homes that are currently owner-occupied. While the chart below shows an increase in LIRA through 2018, declines are expected in 2019.

Despite the lower projected growth, overall spending in home remodeling is expected to increase.

Despite the lower projected growth, overall spending in home remodeling is expected to increase.

“Even so, many other remodeling market indicators including home prices, permit activity, and retail sales of building materials continue to strengthen and will support above-average gains in spending next year,” says Abbe Will, Associate Project Director in the Remodeling Futures Program at the Joint Center. “Through the third quarter of 2019, annual expenditures for residential improvements and repairs by homeowners is still expected to grow to over $350 billion nationally.”

Mortgage Rates on the Move

Secondary mortgage market participant Freddie Mac published the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate mortgage averaged 4.94% for the week ending Nov. 8, 2018, which represents an increase from 4.83% the prior week and last year’s average rate of 3.9%. The rise in rates curbed buyer enthusiasm as existing home sales are on a six-month decline, while new home sales have fallen for the last four months.

“The economy continued to show resilience as strong business activity and growth in employment drove the 30-year fixed mortgage rate to a seven-year high of 4.94% – up 11 basis points from last week,” Freddie Mac Chief Economist Sam Khater said.

On the shorter term mortgage lending side, the 15-year fixed-rate average climbed to 4.33% versus the previous week’s level of 4.23% a week ago and 3.24% during the previous year.