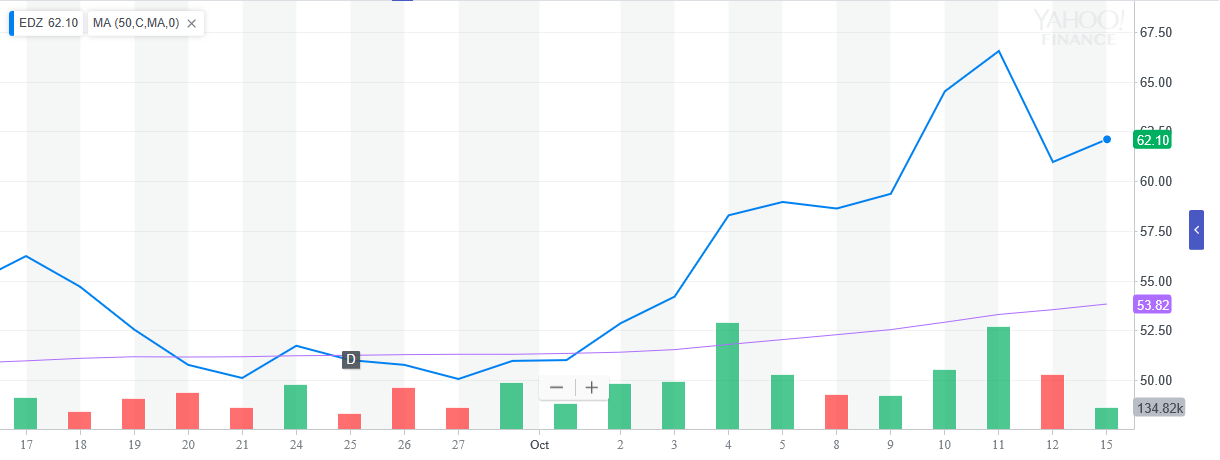

Last week’s sell-off in U.S. equities is spilling over into the emerging markets space, leaving investors to wonder when the strategy for value-hunting in EM turns into outright avoidance. One ETF that has been benefitting from EM’s unceremonious fall from its rise in 2017 is the Direxion Daily MSCI Emerging Markets Bear 3X ETF (NYSEArca: EDZ).

EDZ was up 3.13% today and 12.3% in just the past month as the emerging markets sell-off mimicked that of U.S. equities last week. Per an article in the Wall Street Journal, a number of investors “expect further pain for developing economies, pointing to the jump in Treasury yields, a strengthening dollar and trade tensions.”

![]()

Leveraged ETF Opportunities in India, Brazil

Purchasing broad-based ETFs in emerging markets such as the Vanguard FTSE Emerging Markets ETF (NYSEArca: VWO), iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG) and iShares MSCI Emerging Markets ETF (NYSEArca: EEM) can help with diversification, but can still expose investors to continued aggregate selling pressure from a rising dollar and ongoing trade wars. VWO is down 8.91% year-to-date, IEMG is down 8.24% YTD and EEM is down 8.31%.

Instead, investors can look to emerging markets opportunities that are country-specific to dampen external effects by starting with those that boast the largest gross domestic products, such as India and Brazil as well as ETFs that focus on EM debt.

The International Monetary Fund’s director of fiscal affairs Vitor Gasper said that global debt reached a new high in 2017, topping the $182 trillion mark, but also said that India’s debt, in particular, is much less than global debt as a percentage of the world’s gross domestic product (GDP).

“So, it is substantially less than the global debt as percentage of world GDP,” Gasper said regarding India’s debt, which is below the average of developed and emerging market economies. “There is a positive relation between the debt to GDP ratio and the level of GDP per capita. If you compare around the world with the best economies or emerging market economies, the level of debt in India is lower.”

Furthermore, its economy is experiencing strong year-over-year growth as it grew “8.2 percent year-on-year in the second quarter of 2018, above 7.7 percent in the previous three months and beating market expectations of 7.6 percent. It is the strongest growth rate since the first quarter of 2016, boosted by household spending, financial, real estate and manufacturing activities,” according to Trading Economics.

Source: tradingeconomics.com

Gasper also cited that although private debt in India has increased the last decade, it has tapered off in recent years.

“If you look at emerging market economies, that includes India, you see that private debt in the last 10 years has increased quite substantially, although in the last two years, since the end of 2015, 2016 and 2017, there is a slowdown in the process of leveraging, but debt is very high and public debt is a very high as well,” Gasper said.

Nonetheless, the IMF director still views India as stable relative to other emerging market economies.

“So, it’s very stable. So, what you do see is that emerging market economies, which is where India is, there’s a very fast buildup in private debt with a slowdown in the last two years, But India is basically steady. So, India is not an emerging market economy where leveraging is progressing fast,” said Gasper.

With the rupee experiencing its doldrums this year, India could present investors with discounted opportunities that could benefit INDL if the country’s central bank is able to shore up its local currency. Just today, the Reserve Bank of India announced it would inject 120 billion rupees or US $2.1 billion into its financial system through the purchase of government bonds.

Per Investopedia, “India is the fastest growing trillion-dollar economy in the world and the sixth largest with a nominal GDP of $2.61 trillion. India is poised to become the fifth largest economy overtaking the United Kingdom by 2019 as per the IMF projection.”