By Eric Dutram, DWS

The current and projected market environment is a vital factor to consider when making any asset allocation decision. Two key areas to investigate are growth prospects and the outlook for inflation.

Today, while growth could go in either direction, most analysts seem to agree that inflation’s path is trending higher. Rates have certainly been marching higher, while ultra-low unemployment seems likely to gradually increase workers’ wages.

Against this backdrop, it is important to consider assets that offer the potential to withstand the eroding effects of inflation. One area that meets this criteria – and one that many investors tend to overlook — is infrastructure. Generally speaking, these assets have highly inelastic demand and, in many cases, a monopolistic position. This combination tends to produce limited pricing risk, while allowing for high pass-through capability. Infrastructure generally provides predictable cash flows thanks to its lower level of cyclicality relative to equities and other real assets such as real estate or commodities.

However, there are many types of infrastructure, and some important distinctions need to be made between them. Each can have very different drivers, but one that we believe warrants particular attention is the ‘pure play’ segment of this asset class.

What do we mean by ‘pure play’?

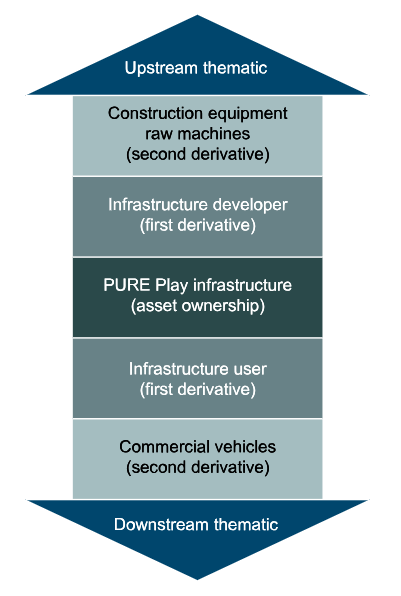

Pure play is the actual ownership or operation of the infrastructure asset. It is the heart of the infrastructure system and the sweet spot between downstream business and upstream activity. It is the actual asset which upstream and downstream businesses rely on for their business, and in many cases, their very existence as well.

For example, an airport is a pure play asset. Companies paving the runways or obtaining materials for the construction of airport facilities are “upstream” while an airline would be “downstream” — a company using the infrastructure. An aircraft manufacturer would be another level away from that on the downstream side.

![]()

In the example above, pricing changes can more easily flow outwards from the middle of the chart thanks to dependence on the infrastructure asset. To an extent in many cases, infrastructure assets represent a monopoly—or close to it—in a given region, forcing others to adapt to their needs, instead of the other way around.

Pure play vs. the rest

This distinction may appear to be a small one, but it can actually have a dramatic impact on performance. Let’s compare a few key global infrastructure benchmarks to get a better handle on the main differences: