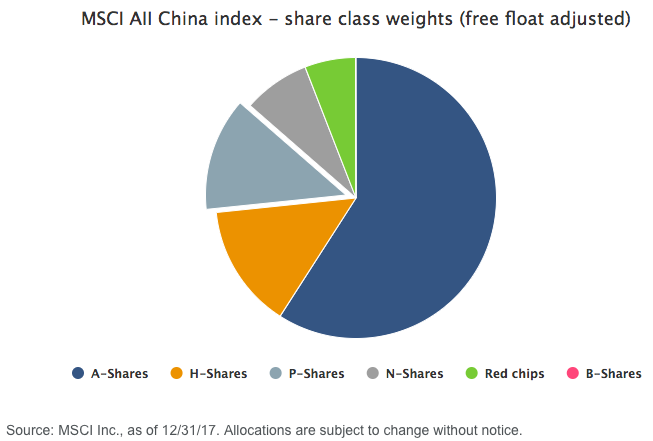

While foreign investing can be a bit intimidating at first, China in particular presents unique challenges for American investors. After all, there is a veritable alphabet soup of share classes out there, ranging from A-Shares to P Chips, with a variety of others in the mix as well (read: China share classes explained).

This system is largely the result of foreign ownership restrictions on Chinese securities, as well as the wide diversity in listing locations for Chinese firms. These include the obvious in mainland China, but also Hong Kong, Singapore, New York, and London, which further adds to the confusion.

Given such a wide variety of choices, it can be difficult to know which area of the market to target, and if investors are getting adequate—and representative—exposure to this vast economy.

In our view, it makes sense to look at the share class that accounts for the biggest weight in the nation. And if you look to the MSCI All China Index, that is far and away A-Shares, which make up more than half of the index.

![]()