![]() While market factor screens have been an attractive feature of the new breed of smart beta ETFs, potential investors should still look under the hood to better understand the underlying strategies.

While market factor screens have been an attractive feature of the new breed of smart beta ETFs, potential investors should still look under the hood to better understand the underlying strategies.

On the recent webcast (available On Demand for CE Credit), Smart Investing is More than Factors, Brandon Rakszawski, Product Manager for VanEck, argued that smart beta or factor-based ETF investments that utilize actively managed investment styles is here to stay as more investors become disillusioned with the underperformance of costly active fund strategies.

Over the past two decades, large blend funds have on average underperformed the S&P 500, and the disparity has only widened in recent years.

On the other hand, smart beta ETFs, which implement traditional actively managed investment styles in a rules-based indexing methodology, have quickly garnered assets, and providers continue to add more smart beta ETF strategies to U.S. markets to meet the growing demand. Over one third of ETPs launched in the U.S. since the start of 2016 are classified as strategic beta or smart beta by Morningstar fund research, and almost half of all assets in those newly launched funds are comprised of strategic beta ETPs.

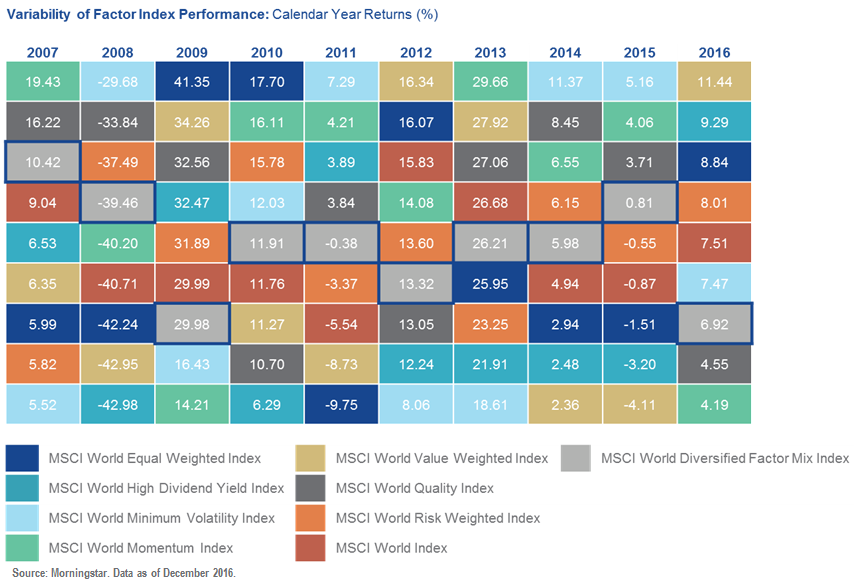

However, Rakszawski warned that while factors are a powerful tool that could help enhance returns, they are not always consistent. For instance, the value factor outperformed across the globe in 2016, but value was the worst performing factor in 2015 as minimum volatility outperformed.