The exchange traded fund industry is still in the early years of its growth spurt, and investors who want to capitalize on the phenomenal expansion can look to a targeted ETF strategy to directly participate in the industry development.

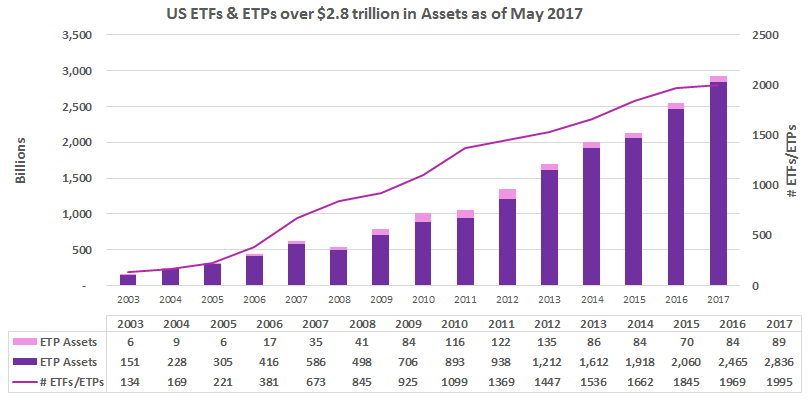

On the recent webcast (available On Demand for CE Credit), How to Capture Insights to the Growth of the ETF Industry, Michael Venuto, Chief Investment Officer of Toroso Asset Management, pointed out that the ETF industry has experienced a rapid 19.4% annual growth rate over the past decade as 1,500 exchange traded products hit the U.S. markets and overall assets grew to around $3 trillion.

Looking forward, Venuto argued that the ETF industry may continue to expand, especially as the upstart ETF companies continue to garner a greater market share of investment assets at the expense of traditional open-end, mutual funds. In the past two years, ETF flows have exceeded mutual fund flows by $635 billion dollars.

Venuto contends that mutual funds have enjoyed some what of an artificial distribution benefit that may soon end, such as with 401(k)s and retirement savings demand.