By Rob Stein, CEO and Founder, Astor Investment Management

Over the past few years, financial advisors and their clients, in search of low-cost ways to capture market performance, have piled into passive investment strategies.

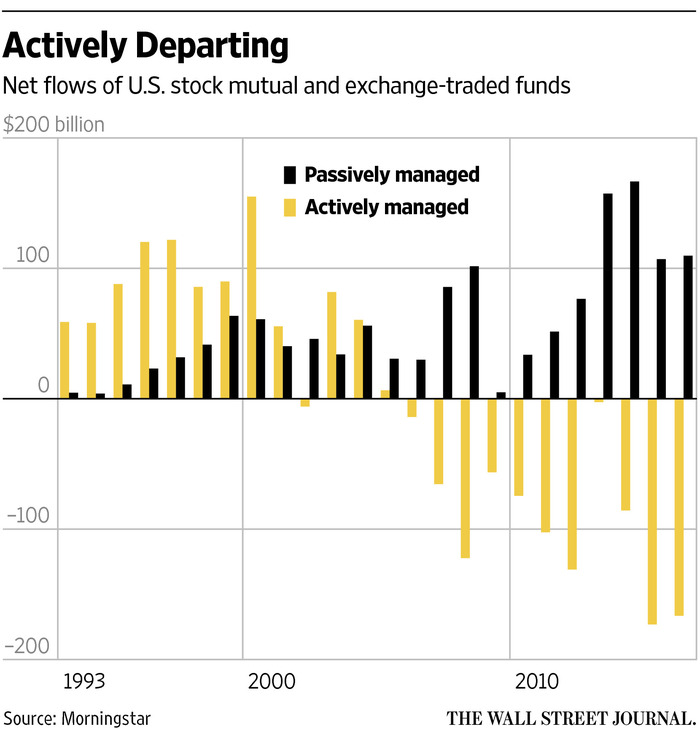

As the Wall Street Journal reported recently, for the three years ended Aug. 31, 2016, nearly $1.3 trillion flowed into passive mutual funds and ETFs. For investors, it seemed like a “no-brainer” move in a low-risk, low-volatility environment, with an upward trend for equities.

For years, I’ve been advising investors not to pay up for “beta”—that is, market exposure that is far easier and cheaper to capture with an ETF that seeks to replicate the S&P 500 or another index. But the rush to jump into passive and dump active may have thrown out the proverbial baby with the bathwater. There is growing evidence that active investing is coming back into favor. As Barron’s reported, since July 1, 60% of actively managed funds are beating the S&P 500, the highest level in nearly two decades.

At Astor, we believe now may be the opportune time to revisit active strategies that might not be the lowest cost, but may be meaningful in helping investors achieve their portfolio goals. For example, the Astor Dynamic Allocation Strategy (formerly known as Long/Short Balanced and is available as SMA and a Mutual Fund) has outperformed the HFRI Total Macro Index (See Exhibit 4: Performance) in nearly every year since 2005 (and in the years it did not outperform, it was pretty close) and is on track to outperform again in 2016.

Not an ‘Either-Or’ Choice

To be clear, I’m not suggesting that passive’s time has passed; however, it appears to be getting long in the tooth, with signs of becoming a “crowded trade,” given the amount of money piling into passive funds, as the chart below indicates. (Source: The Wall Street Journal)