Exchange traded funds (ETFs) continue to dominate cash flows into investor portfolios — and for very good reasons.

But ETFs have one feature that is dangerous for many investors, so it’s up to investment advisors and ETF Strategists to ensure these useful investment vehicles are properly managed.

ETFs are grabbing big chunks of market share from mutual funds, and they will continue doing so in the year ahead. Though mutual funds truly rank among the top innovations in the history of finance (they provided the opportunity for all investors to attain diversified, professionally managed portfolios at a reasonable price), ETFs are a better technology. And that’s good for investors.

There are a few reasons ETFs are better.

First, ETFs have lower costs (including lower tax costs). There’s a lot made of how investors are moving from active management (being different from benchmarks) to passive management (matching benchmarks). While technically that might appear to be right, I disagree that investors really want to switch. Active versus passive is something investors don’t really care about. If anything, most investors still prefer active investing. The real reason behind movement in investor assets, however, is from higher-cost to lower-cost portfolios. While index funds and ETFs are indeed passive, they are, more importantly, cheaper. Because of their lower costs, ETFs are winning interest and assets.

Second, ETFs don’t have bad hair days like mutual funds often do. Since ETFs are rules-based and track specific benchmarks (unlike many actively managed mutual funds) they are never subject to their portfolio managers waking up on the wrong side of the bed, dealing with personal issues, or suddenly leaving the portfolio management responsibilities for one reason or another. Instead, ETFs execute their investment processes each and every day. In turn, ETFs are dependable, reliable portfolios. They are portfolio building blocks that investors can count on.

But there’s one factor often stated as a virtue of ETFs, which appears to probably be more of a curse than a blessing. ETFs are exchange-traded. In other words, like stocks, ETFs can be traded all day long during market hours. Some people love the fact that ETFs can be traded without interruption, but for most investors, this is not an advantage.

The biggest issue with investors — even more than costs — is emotional trading/investing and chasing performance (buying stuff after it’s gone up in price and selling after it’s gone down in price).

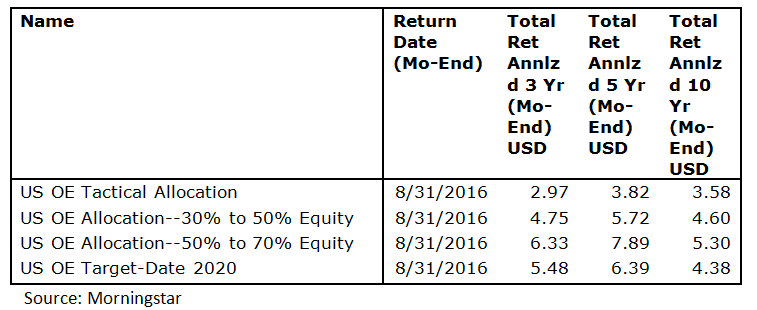

The numbers don’t lie. Extremely active or emotional (or both) trading/investing doesn’t work. On this point, let’s first consider the track record of professional investors who are tactical money managers —meaning they can make big changes to their portfolios in terms of allocations to stocks and market risk.

Bottom line, it’s not good. In fact, it’s dismal, as this recent data from Morningstar illustrates.