Note: This article appears on the ETFtrends.com Strategist Channel

By Bill O’Grady & Kaisa Stucke, CFA

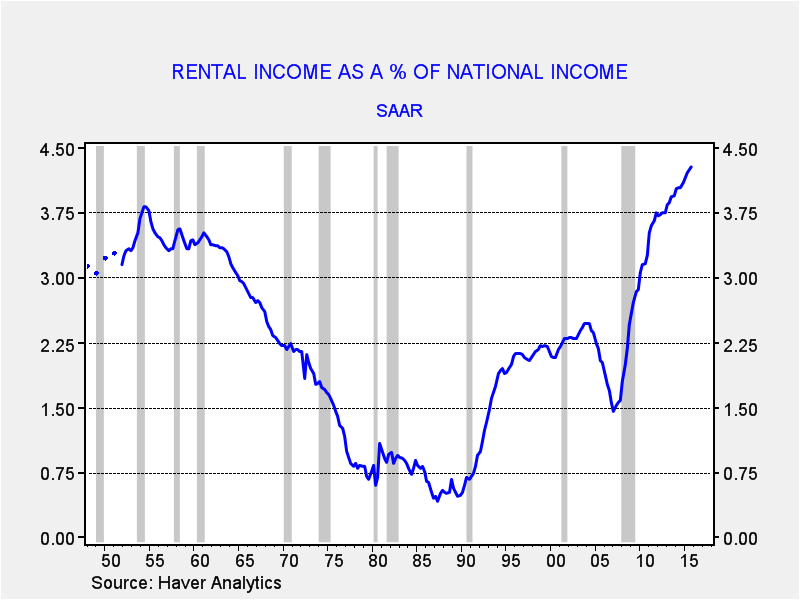

In our latest adjustment to the asset allocation portfolios, we added to the Real Estate Investment Trust (REIT) positions in three of the four models. One of the reasons we remain friendly to this asset class has been the steady increase in rental income.

This chart shows rental income from the National Income and Product Accounts (NIPA). Note that rental income has been rising at a very fast pace since the housing crisis. In fact, as a percentage of national income, rents are at a postwar high, exceeding 4.25%.

In general, history shows that rising rental income tends to support rising REIT values.