Here is a dramatic chart:

It provides a complete history of the trajectory of interest rates over the last sixty years—and also the backdrop for why there’s so much ado about rates today. It also explains the consensus sentiment that there is only one direction for interest rates to head. We have no desire to enter the pervasive discourse around the timing and pace of the expected rise in interest rates. But we can suggest three important things that will not happen when interest rates do rise.

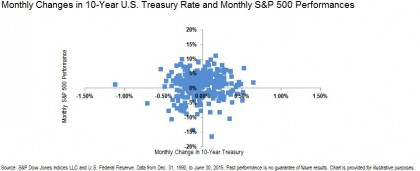

First, rising rates won’t foretell the direction of the stock market, as the next chart illustrates.

Conventional wisdom is that rising interest rates are bad for equities. But in the last 25 years, the presumed relationship between equity performance and interest rates has been severely challenged.

Second, rising rates won’t foretell whether stock market dispersion will widen. Dispersion is a measure of the degree to which the components of an index perform similarly. If the components are tightly bunched, dispersion will be low and, other things equal, active managers will be challenged to add value by stock selection.