With the majority of the fixed income world taking sides on prize fights like Greece, the European Central Bank (ECB), inflation, and energy-related debt, you may have missed the beating leveraged loans have been receiving in the media.

The Financial Industry Regulatory Authority (FINRA) cited senior loan liquidity concerns in their January letter, stating “…these loans could face liquidity challenges if a significant number of investors make redemption requests at the same time.” Forbes published an article last week observing outflows in the bank loan market 39 of the last 40 weeks, totaling USD 25.9 billion in redemptions from the asset class. How did loans fair in the redemption ring?

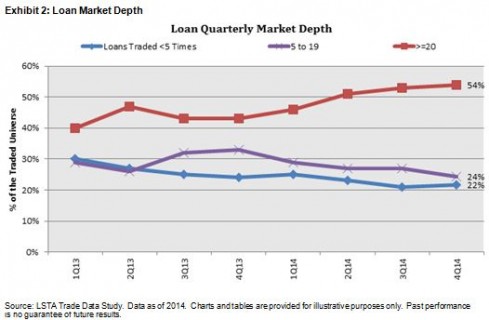

The Loan Syndications & Trading Association (LSTA) saw bank loan trading volumes increase 21.5% in 2014, to a record $628 billion, from the previous year (Exhibit 1). The LSTA also observed record market depth in the fourth quarter of 2014. In Q4 2014, over 54% of the 1,750 loan facilities traded, traded 20 times or more (see Exhibit 2).

While we all know past performance is not indicative of future performance, in times of record redemptions, why is the dialogue focused on liquidity concerns versus liquidity metrics? It is also worth noting that during the final nine months of 2014, bank loan mutual funds were able to meet over USD 28 billion redemption requests in every single case.