Looking at gold fundamentals, exploration budgets have collapsed and we may be seeing peak gold supplies. For example, Barrick Gold recently reported lowest quarterly output in 16 years.

Meanwhile, there is lingering geopolitical risks that may continue to drive risk-off events. Gold is already priced at a one-year high in Europe due to political uncertainty in Italy amid fears of an Italy break from the euro bloc.

Lastly, Holmes argued that unwinding of quantitative easing here and in Europe could also contribute to gold safe-haven demand.

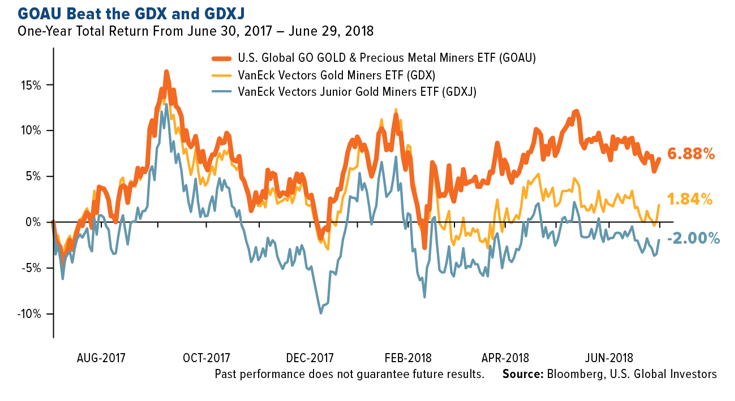

As investors look to gold plays, consider a smart gold miner ETF like the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSEArca: GOAU). GOAU is a smart beta offering that tracks a specialized or rules-based index to help hone in on quality players in the gold mining space. The underlying U.S. Global GO GOLD and Precious Metal Miners Index uses quantitative analysis to pick stocks, with a particular focus on royalty companies.

“Royalty companies serve as specialized financiers that provide upfront capital to help fund producers’ exploration and production projects. They receive royalties on what is produced or rights to a ‘stream,’ an agreed-upon amount of gold, silver or other precious metal at a fixed, lower-than-market price,” Holmes explained.

U.S. Global believes royalty companies are a superior way to target the gold mining segment because they offer more stable revenue and cash flow, show rising book value per share, have high revenue per employee and have low SG&A to revenue, which have contributed to the outperformance to gold bullion and the broader gold producer segment.

![]()

For example, Wheaton Precious Metals, which makes up 10.1% of GOAU’s underlying portfolio, has exhibited many of the attractive traits investors may find within a gold mining company. Randy Smallwood, CEO of Wheaton Precious Metals, explained how the company has a diversified portfolio of high quality assets across the globe and has capitalized on precious metals streaming.

Holmes showed that many of these royalty mining companies exhibit stronger fundamentals. These royalty companies have a greater revenue per employee model than other producers and hold little or no debt. The stronger fundamentals have also translated well into outperformance as GOAU’s portfolio has outpaced other popular gold miner ETF plays over the past year.

Financial advisors who are interested in learning more about the gold market can watch the webcast here on demand.