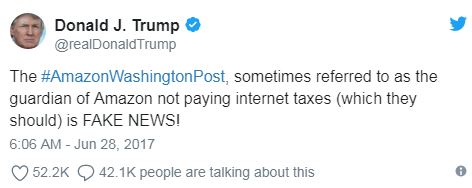

Trump also tweeted, “The #AmazonWashingtonPost, sometimes referred to as the guardian of Amazon not paying internet taxes (which they should) is FAKE NEWS!”

![]()

![]()

Amazon Effect on Retail Landscape

According to CNBC, Amazon shares fell 5.4 percent Wednesday after the report, wiping out nearly $39 billion in shareholder value.

While Amazon already imposes the applicable state sales tax on goods it sells, many third-party sellers on Amazon do not collect those taxes.

Related: ETFs to Consider as Toys R Us and Sears Close Stores

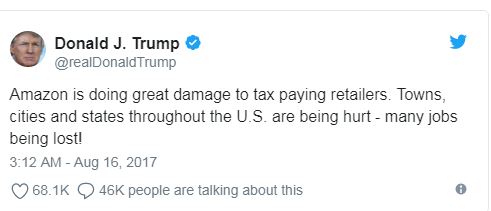

According to Business Insider, “Concern over Amazon’s effect on the American retail landscape is widely held. But Trump’s grumblings about the company’s relationship with the US Postal Service seem unfounded, given that much of the USPS’ financial woes come from funding mismanagement, pension obligations, and the non-package side of its business.

Amazon declined to comment.

Retail ETFs Capitalize on Misfortune or Fall Victim to It

Here’s a look at how three retail related ETFs are tracking year-to-date, according to Yahoo Finance.

The ProShares Decline of the Retl Store ETF (EMTY) is down .76% while the Proshares Long Online/Short Stores ETF (NYSE Ara: CLIX) is up 17.76%.

Meanwhile, the SPDR S&P Retail ETF (XRT) is down .22 %. This ETF remains one of the worst performing areas of the market this year.

For more information on current affairs, visit our current affairs category.