Global X MSCI Portugal ETF (PGAL)

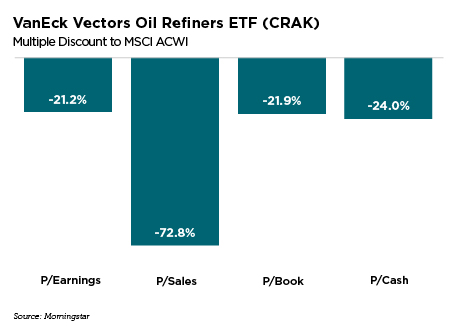

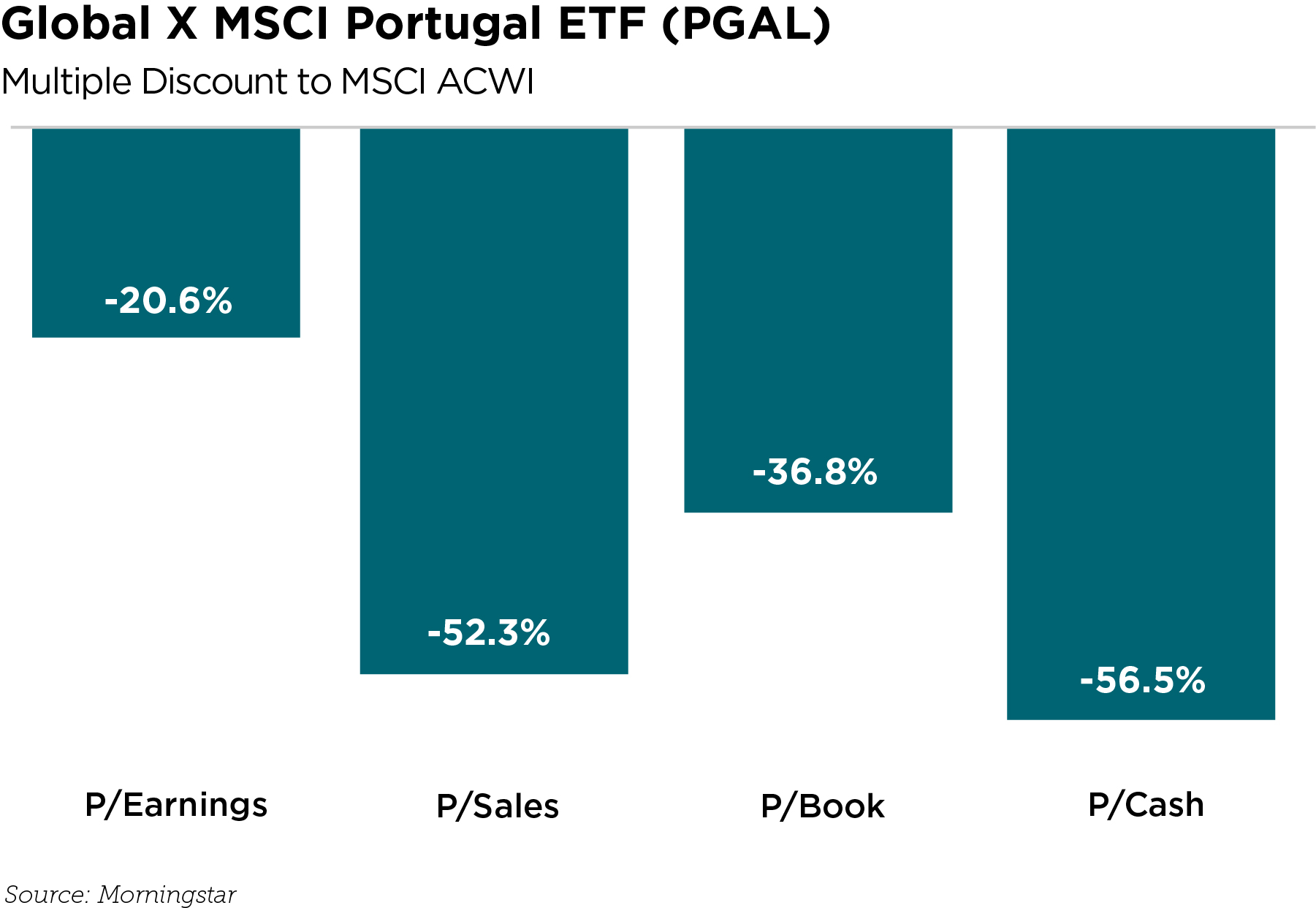

An economic recovery is underway in Europe, particularly in some of the periphery countries that have been beaten down by multiple financial crises. The recoveries in Spain and Italy have been well documented, but another economy is growing at nearly a 3% annualized pace: Portugal! There is only one ETF with significant exposure to Portugal, the Global X MSCI Portugal ETF (a few others, GVAL and, ironically, CRAK, have less than 10% exposure to Portugal). This year, PGAL is one of the best performing European ETFs, up nearly 30% and besting the likes of Spain, Germany, France, and the always-wild Greece. Despite this run up, the ETF and underlying market is still remarkably cheap, as shown in the discounts below.

There are likely several other diamonds in the rough in the ETF world. It takes careful due diligence to find opportunities and allocate to them appropriately, but putting in the work can lead to outsized returns for investors. The aforementioned ETFs are all low in assets (currently) and likely not on the radar of many investors, but that doesn’t mean they aren’t worthwhile. As ETFs grow, so too do the opportunities for those paying attention!

Grant Engelbart is a Portfolio Manager at CLS Investments, a participant in the ETF Strategist Channel.

At the time of writing, CLS Investments, LLC did not own any of the aforementioned ETFs. 3006-CLS-9/27/2017