The team at GMO recently came out with their mid-year investor letter and one chart raised some alarm bells.

In the chart below, we see that in the seven years ending March 2000, earnings forecasts were growing at a very healthy clip—over 11% per year. The issue was that excitement for technology stocks was so high that prices grew 69% faster.

In the seven years ending March 2021, prices have now grown 70% more than earnings forecasts.

These rising price levels are symbolic of more elevated market valuations—which gets magnified in market capitalization-weighted indexes that lean heavier into stocks that are already rising the most.

Reconnecting Stocks with their Earnings

In February 2007, WisdomTree launched a suite of earnings-weighted stock indexes that reconnects stock allocations to their underlying earnings. The valuation discounts we see today in this earnings-weighted family are some of the widest gaps compared to their market cap-weighted counterparts that we’ve seen since inception.

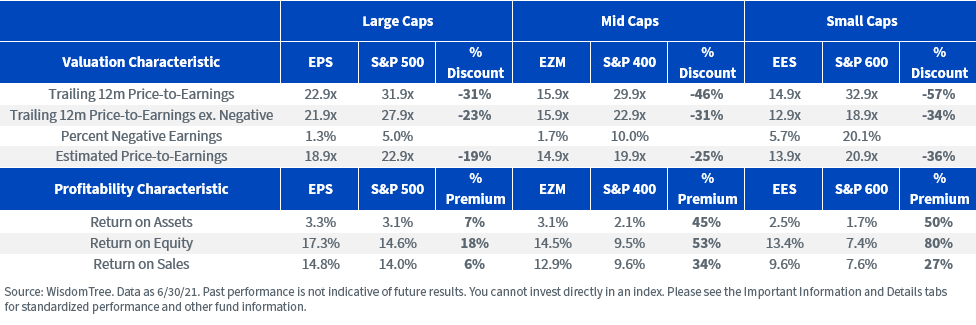

Using trailing earnings, which makes the market look more expensive, the valuation gaps for WisdomTree’s earnings-weighted strategies compared to the S&P family of market cap-weighted benchmarks, ranges from 31% for large caps to 57% for small caps.

Using estimated earnings for 2021, the valuations look more reasonable for the cap-weighted market: around 23 times for S&P 500 and 20–21 times for mid and small caps.

The discount for WisdomTree’s earnings-weighted strategies using forward-looking earnings ranges from 19% for large caps to 36% for small caps.

Often, one assumes you sacrifice quality and profitability and get ‘junkier’ stocks when you look for valuation discounts. But the earnings-weighted approach and additional risk screens we added to our Indexes have led to profitability premiums across all size segments. You can see this in profit margins (return on sales), ROE or ROA metrics.

In the below tables, we compare the WisdomTree U.S. LargeCap Fund (EPS), WisdomTree U.S. MidCap Fund (EZM) and WisdomTree U.S. SmallCap Fund (EES) relative to their corresponding market cap-weighted Indexes, based on size.

For standardized performance of the Funds in the table, please click their respective ticker: EPS, EZM, EES.

For definitions of terms in the table, please visit the glossary.

Forward P/E Ratios: The Earnings-Weighted Discounts

The more market valuations rise, the more important we believe it is to reconnect stock weights with their underlying earnings. As investors talk more about the value rotation, WisdomTree’s family provides very broad-based diversified exposure to these size segments, without having specific valuation cutoffs to sort the market and only select a subset of the market.

These Indexes start with all profitable companies in their universes, and then weight those companies by their core earnings streams and make adjustments for the most risky stocks in their universe. Now could be a particularly good time for both elements of this lower valuation and risk-controlled process.

Originally published by WisdomTree, 8/12/21

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Funds focusing their investments on certain sectors and/or smaller companies increase their vulnerability to any single economic or regulatory development. This may result in greater share price volatility. Please read each Fund’s prospectus for specific details regarding the Fund’s risk profile.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.