Beyond simple cryptocurrencies, investments in blockchain technology can add value to portfolios because of the myriad potential applications of data-sharing technology.

Potential applications of blockchain technology run the gamut, from central bank digital currencies to voting, real estate, and food safety.

In particular, blockchain’s applications in supply chain management and healthcare became major points of interest during the COVID-19 pandemic, as flaws in both systems were exposed.

Utilizing blockchain technology could provide opportunities to improve the efficiency, security, and connectivity of these systems—three areas where both supply chains and healthcare fell short.

What Is Blockchain?

Blockchain is essentially a decentralized database shared across a network of users that records transactions and tracks assets within the network.

Blockchain is so called because it stores transaction data in “blocks” connected in a chain. These blocks record and confirm transaction’s time and sequence, and are added to the chain depending on the rules of the specific network.

Although blockchain is often associated with digital commodities, such as Bitcoin and other cryptocurrencies, the technology can be used to track all sorts of assets in a variety of sectors.

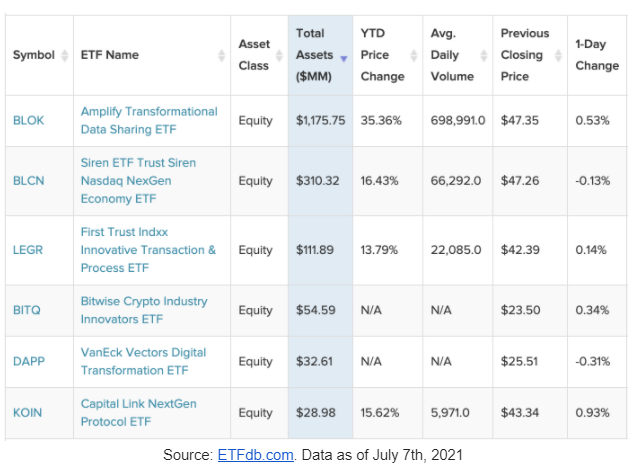

By our count, there are currently six blockchain ETFs traded in the U.S., although more may be on the way.

All of the blockchain ETFs currently on the market are invested in companies developing and using blockchain technology, while some also invest in small amounts in futures and options linked to the performance of cryptocurrency investment products offered by asset managers.

The Amplify Transformational Data Sharing ETF (BLOK), the largest of these funds, invests at least 80% of its assets in blockchain users and developers. The fund has 47 holdings and an expense ratio of 0.71%.

See also: Breaking Down ‘BLOK’: Inside the Portfolio

The size of the global blockchain market could grow from $3 billion in 2020 to $39.7 billion in the next five years, according to a recent market report. This would represent a compound annual growth rate of 67.3%.

For more news, information, and strategy, visit the Crypto Channel.