Investors looking for immediate, yet diversified, boosts to their income can look toward ETFs with high dividend yields.

Dividend yield is a measure of how much of security’s value is returned to shareholders in the form of dividends.

In the case of ETFs, each fund holds many stocks that may pay out dividends; those dividends are aggregated into a single payment to the shareholder at the ETF level. To calculate an ETF’s dividend yield, simply divide that most recent dividend by the current share price of the ETF.

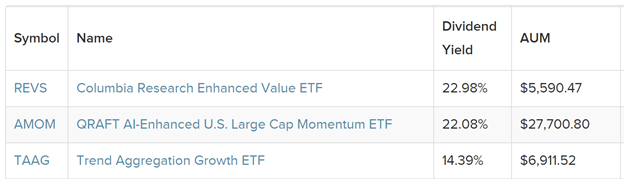

The three highest dividend yielding ETFs are investigated in more detail below.

Source: ETF Database. Data as of June 1, 2021.

Rev Up Your Income with REVS

The Columbia Advantage Enhanced Value ETF (REVS) is a large cap value equity ETF with a dividend yield of 22.98%.

The fund uses proprietary quantitative research to selectively remove the bottom-performing stocks of the Russell 1000 Value Index.

Large caps tend to be more mature companies, less prone to volatile price swings than small- or mid-cap companies. Johnson and Johnson (JNJ), Citigroup (C), and Verizon (VZ) are REVS’ top three holdings, accounting for 3.36%, 3.03%, and 2.98% of the portfolio, respectively.

Okay Computer

The ETF second highest dividend yield is the QRAFT AI-Enhanced U.S. Large Cap Momentum ETF (AMOM), with a dividend yield of 20.98%.

AMOM uses artificial intelligence to select and invest in U.S. large cap momentum stocks.

Because this fund is run by AI, its portfolio changes tend to get media attention, such as last month, when AMOM loaded up on Tesla shares after the stock’s price plummeted. Its current top holdings are Facebook (FB) at 8.16%, Amazon (AMZN) at 7.52%, Tesla (TSLA) at 5.53%, and fellow AI-centric company Nvidia (NVDA) at 4.27%.

Tag Into TAAG

The ETF with the third highest dividend yield is the Trend Aggregation Growth ETF (TAAG), an all-cap equity ETF with a dividend yield of 14.39%.

TAAG employs a number of approaches, including a proprietary quantitative process that measures momentum; and multiple investment models that combine market trend and counter-trend following, pattern recognition, and market analysis across asset classes to determine what to buy, what to sell, and what to hold.

The current biggest holdings in the fund include Tesla (TSLA) at 0.84%, Alphabet Inc. Class C (GOOG) at 0.83%, and Entegris Inc. (ENTG) at 0.82%.

For more news, information, and strategy, visit the Dividend Channel.