China’s recent crackdown on tech has created an unintended gap between onshore and offshore Chinese companies, with offshore firms being hit hard by new regulations, according to the Wall Street Journal.

Chinese A-shares, which are shares of Chinese companies listed on Chinese exchanges, stand to benefit greatly in this growing gap.

The MSCI China Index, which includes A-shares, H-shares, B-shares, red chips, P chips, and ADRs, slants heavily towards tech names, including internet companies that have recently been targeted by Chinese anticompetitive regulations.

Five of those companies – Tencent, Alibaba, Meituan, JD.com, and Pinduoduo – make up 35% of the index, and are listed outside China (meaning they are not A-shares).

Meanwhile, A-shares companies lean more heavily towards the industrial, consumer-staples, and financial sectors, areas that have escaped the Chinese tech crackdown.

The largest ETF that tracks the MSCI China Index, the iShares MSCI China ETF (MCHI), is up 24% over a 12-month period.

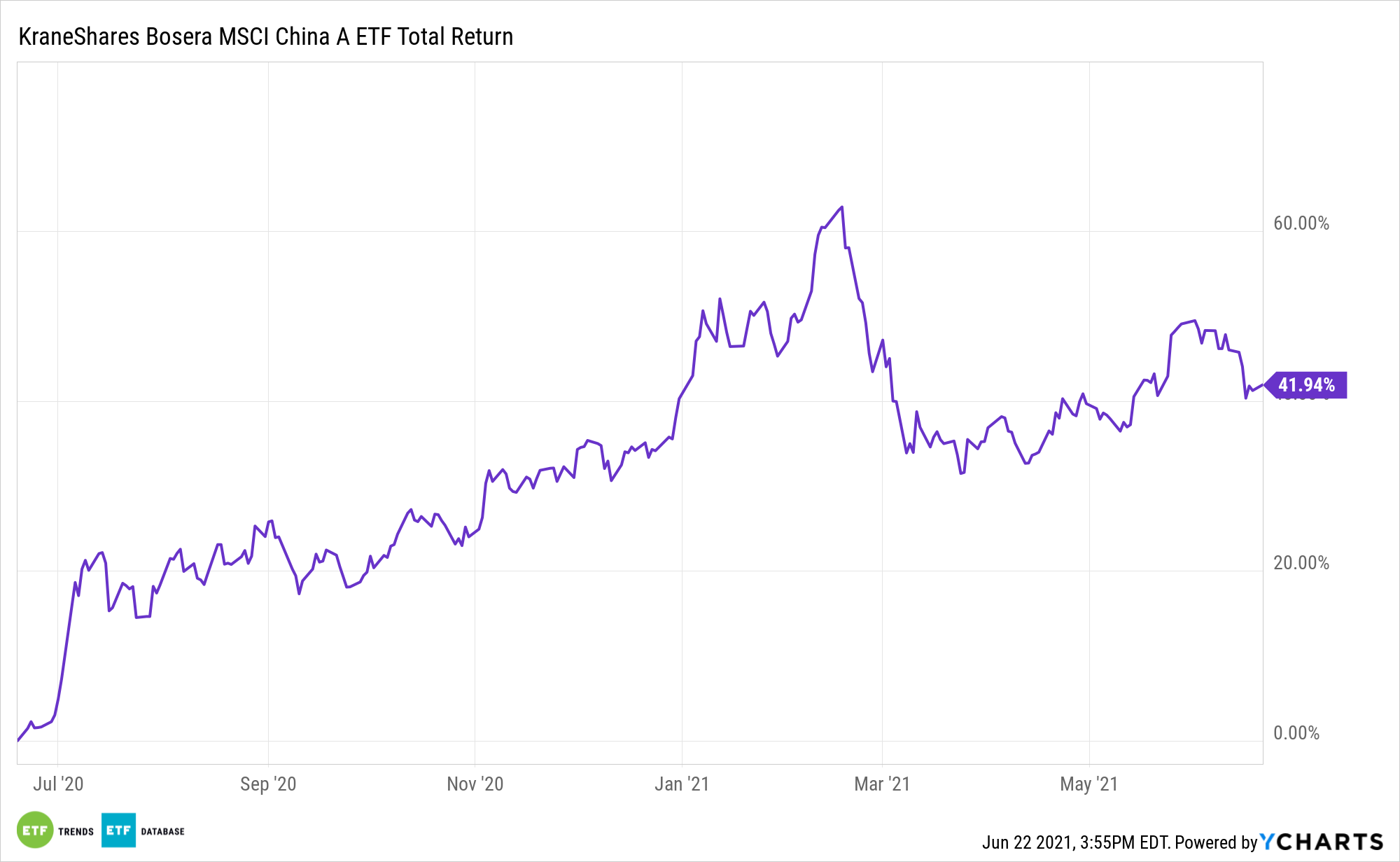

However, the KraneShares Bosera MSCI China A Share ETF (KBA), which tracks the MSCI China A Share Index and exclusively holds A-shares, is up 42% over the same period.

See also: KBA vs MCHI: Head-to-Head Comparison

Investing in China’s A-Shares with KBA

At $854 million in assets under management, KBA remains the largest MSCI-linked China A-share ETF available in the U.S.

KBA tracks mid-cap and large-cap Chinese equities listed on the Shenzhen and Shanghai Stock Exchanges, which historically have been closed to U.S. investors.

The ETF offers an exposure across a wide array of sectors, with 20.37% of the portfolio invested in financial stocks, 19.38% in consumer staples, 12.5% in industrials, 12% in healthcare, and 11.85% in information technology.

KBA’s top three holdings include Kweichow Moutai Co Ltd-A, a Chinese liquor company (6.46%), Wuliangye Yibin Co Ltd-A, another Chinese alcoholic beverage company (2.72%), and China Merchants Bank-A, a Chinese commercial bank (2.71%).

For more news, information, and strategy, visit the China Insights Channel.