By Rob Williams, Director of Research, Sage Advisory

While growth, earnings, and liquidity conditions are expected to remain highly supportive to risk assets, given strong returns this year and stretched valuations, some volatility (which we’re already experiencing) is likely over the coming months. Additionally, weaker summer seasonality is coming for equities and could collide with the need for the Fed to start messaging a tapering plan in the next couple of meetings.

As we look across our tactical portfolios, we have followed three main themes for some time, summed up as positioning for Reopening, Reflationary dynamics, and lower Rate sensitivity. We would caution, however, that all three have evolved to recognize higher valuations, a more mature recovery, and risks of market consolidation.

- Reopening – Strong Momentum, but a Possible Collision in Late Summer

Macro fundamentals remain highly supportive for equities, but we are entering a traditionally more difficult seasonal period for returns. This year has so far followed a typical pattern of positive and progressively better returns into spring, with much stronger levels. We caution a dangerous set up as we move into late summer, as strong returns and stretched valuations may collide with a Fed starting to message its pullback plans.

Seasonal Returns

S&P 500 Average Monthly Returns Last 35yrs

2. Reflationary Dynamics – The Reflation Trade & Rate Pause Will Be Short-Lived

The value rotation that started back in the fall of 2020 has coincided closely with rising rates. Both took a pause in April after several months of steady gains, but they look set to resume momentum given the growth and inflation outlook. This suggests sticking with reflation assets, such as value and small caps, and sectors with less sensitivity to rising rates.

Value Equity Performance and Rates

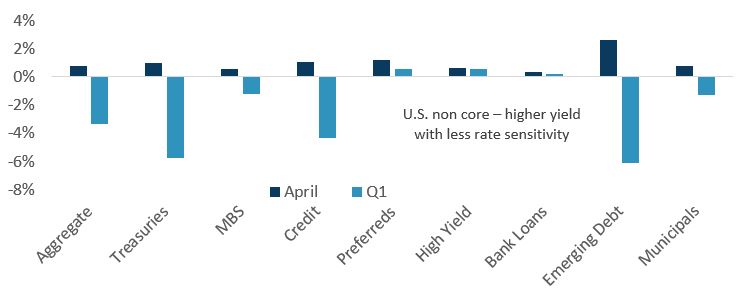

3. Rate Sensitivity – Non-Core Bonds Still Offer the Best Risk/Reward

The rate pause was a welcome change for bond investors, with positive returns in April across all major bond sectors. Comparing recent returns to Q1 highlights the effect of duration (or rate sensitivity) on returns in a rising rate market. Diversification into non-core markets like high yield and bank loans paid off in Q1 and continues to make sense.

Bond Market Returns

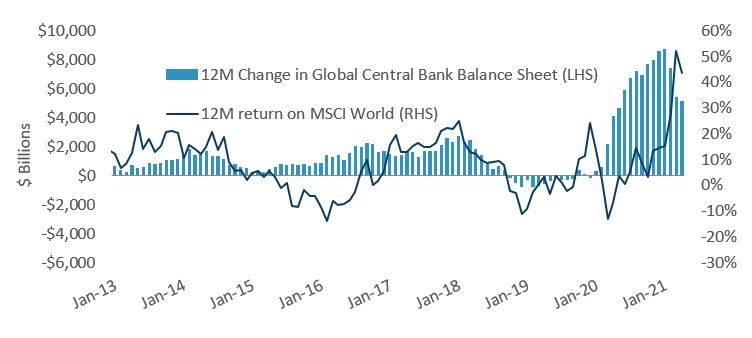

A key indicator to watch over the next couple quarters will be how central banks message monetary policy support. While politicians may get more headlines, how global central banks proceed with respect to pulling back on extraordinary levels of stimulus will be a larger driver of rates and risk asset prices. Past periods associated with “tapering” the pace of support has caused a reversal in risk-taking. Some central banks (e.g., Bank of England, Bank of Canada) have already begun this process, and the Fed could begin to message its plans as early as this summer.

Central Bank Support and Equities

Disclosures: This is for informational purposes only and is not intended as investment advice or an offer or solicitation with respect to the purchase or sale of any security, strategy or investment product. Although the statements of fact, information, charts, analysis and data in this report have been obtained from, and are based upon, sources Sage believes to be reliable, we do not guarantee their accuracy, and the underlying information, data, figures and publicly available information has not been verified or audited for accuracy or completeness by Sage. Additionally, we do not represent that the information, data, analysis and charts are accurate or complete, and as such should not be relied upon as such. All results included in this report constitute Sage’s opinions as of the date of this report and are subject to change without notice due to various factors, such as market conditions. Investors should make their own decisions on investment strategies based on their specific investment objectives and financial circumstances. All investments contain risk and may lose value. Past performance is not a guarantee of future results.

Sage Advisory Services, Ltd. Co. is a registered investment adviser that provides investment management services for a variety of institutions and high net worth individuals. For additional information on Sage and its investment management services, please view our web site at www.sageadvisory.com, or refer to our Form ADV, which is available upon request by calling 512.327.5530.