![]()

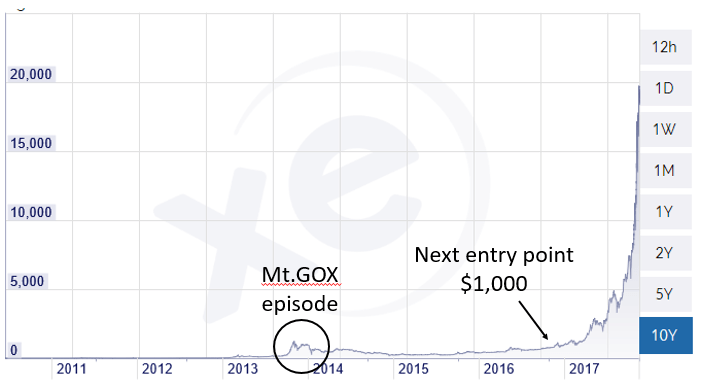

Bitcoin price in 2013/14

Security

The cryptocurrency area is rife with predatory schemes. Many trading platforms were established with the goal of embezzling funds, and many rival cryptocurrencies were started with a singular aim to pump and dump. i.e. lure in seed investors to ramp up the price with demand, only for the founders to sellout their stake for highly inflated sums.

The mistake I made with Mt.GOX was not moving my coins to a secure wallet that was under my control. By retaining them in the account, they were not cryptographically secure. In a way, this is the difference between holding money at the bank, or putting it in a secure safe in your home. Clearly mainstream banks in the US are established organizations with oversight and safety nets, but in Bitcoin space Mt.GOX was the Cactus Gulch Bank of the Wild West.

It was a sobering experience full of “what-ifs” and personal recriminations.

It was almost three years before I decided to dip my toe in the cryptocurrency pond again.

Second Purchase

Over the intervening years, I had been monitoring the Bitcoin market and playing with some market signals derived from Google search analytics. With the advent of more established mainstream exchanges like Coinbase there was no doubt that Bitcoin was becoming more established. It had also seen huge ups and down over that period. Perhaps not by the standards we have seen in the last few months, but by any measure of investment volatility, this thing was crazy!

So I bought in at about BTC 1 = $1030 in late 2016. I had licked my wounds from the Mt.GOX episode but I did not have the stomach for another sickening loss, so I limited my investment to a very modest amount.

We all know what happened next.

Bitcoin went up like a rocket, and so did my second investment. However given the small sum, I have not made a life-changing amount of money and will have to stick to my day job.

So I would add one more aspect to the investment maxim – Be Early, Be Right, and Go Large!

Up like a rocket!

What Did I Learn?

Recently I sold my original stake amount and now I just have the pure profit invested in cryptocurrencies. This means I’m now playing with house money and anything I make is pure profit. I have the security of knowing that unlike my first experience I can’t lose my original investment.

I’ve also diversified to a couple of different coins. There are hundreds of types of cryptocurrencies in existence, but very few (none?) are reputable, so the chance of choosing the next hot one is quite low. There is also significant idiosyncratic risk from a single currency. You are exposed to deficiencies in the core code and potential “forks” where the coins can lose value through the community arguing about the future development paths.

Finally, I never keep my coins on the trading platform, I always transfer them out to my own wallet where I control the private key. I really should get a hardware wallet and take my coins offline completely, but as with everything I have to balance risk and convenience, my time has value.

This article was republished with permission from actuaryonfire.com.