What makes the delay in policy implementation so important is that the Fed has already adjusted monetary policy as a result of the market reaction to Trump’s victory, hiking interest rates twice since the election, projecting two more hikes in 2017, and signaling that they intend to shrink their balance sheet this year. However, if expansionary fiscal policies aren’t forthcoming, it introduces the risk that the Fed is tightening policy too quickly. That risk can be viewed by both the recent flattening of the yield curve and in the decline in bank lending to corporations.

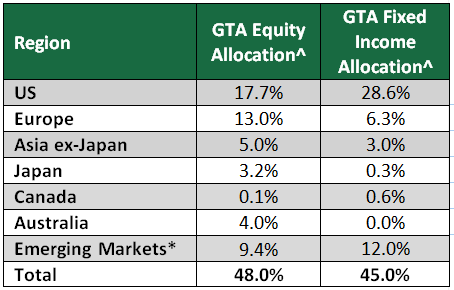

As a result of this environment, we feel that US equities outside of certain sectors no longer merit the valuation premium that they enjoy versus the rest of the world, and we instead favor international equities.

We have written extensively about the political backdrop in Europe this year, arguing that moderate candidates would prevail and have the chance to forge much-needed reforms. This would represent a major tailwind for European assets, and we have positioned our portfolios accordingly. The most important election of the year takes place in France at the end of the month (polls shown on the right), and we expect to increase our European equity allocation if Emmanuel Macron can secure the presidency.

- We are avoiding foreign currency fixed income to benefit from higher US dollar interest rates.

- Our fixed income portfolio adopts a barbell approach: we own long-duration sovereign bonds counterbalanced by high yield bonds and preferred stock.

- Our US equity exposure is limited to four sectors: financials, technology, biotech, and aerospace & defense.

- We expect European politics this year to move away from the populist and nationalist forces that have caused upheaval in recent years, benefitting our positions in Eurozone equities and the European financial sector.

- Japanese equities are supported by the Bank of Japan’s ongoing aggressive monetary easing, and we expect the Yen to continue its decline against the dollar this year, which would support our position in currency-hedged equities.

- Australian equities are supported by expansionary fiscal policy. They also give our portfolio exposure to commodity prices, which we have very little of elsewhere.

- Emerging markets offer attractive relative value, and capital flows have improved following the adverse credit conditions faced by those countries during the US dollar rally and interest rate increases since mid-2014.

- Gold’s status as an alternative currency should support it as global central banks continue to pursue extremely aggressive policies and geopolitical risks remain elevated. Furthermore, as an asset with low correlations to most others, it helps lower overall portfolio volatility.

This article was written by John Forlines III, chairman and chief investment officer, at JAForlines, a participant in the ETF Trends Strategist Channel.