As a rising group of wealthy and socially conscientious millennial investors grow up, socially responsible investments and environmental, social and governance (ESG) related exchange traded funds may play a greater role in a diversified portfolio.

On the recent webcast, The Role of ESG Strategies and the Millennial Investors, Ned Dane, Head of Private Client Group at OppenheimerFunds, illustrated the importance of affluent millennials in the investment community ahead as we are about to experience one of the largest wealth transfers of our time.

Specifically, $59 trillion is expected to pass down to heirs, charities and taxes, with the baby boomer generation set to transfer $30 trillion to millennials.

“The largest intergenerational wealth transfer in recorded history is now underway,” Dane said. “When money transfers from one generation to the next, it’s a significantly disruptive event for wealthy families.”

Consequently, it is important for the investment community and industry to recognize the critical role that affluent millennials will play as they acquire more wealth and be put in charge of family portfolios. For instance, surveys have shown that many millennials favor impact investing, which seeks to provide societal or environmental benefits in addition to sustainable investment returns.

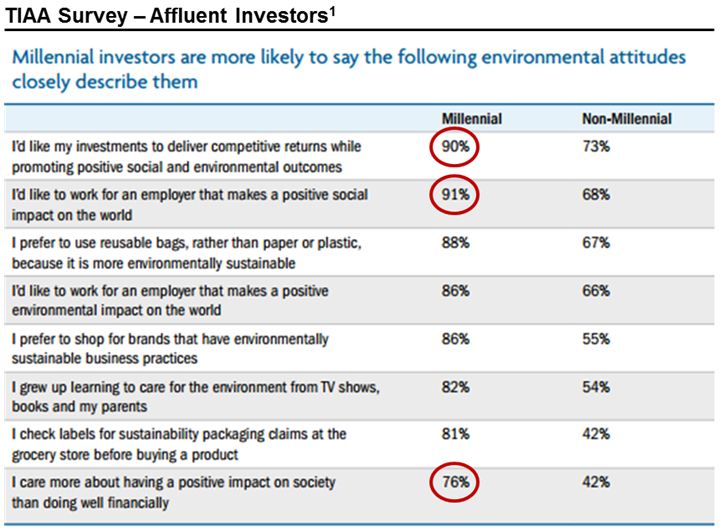

Sharon French, Head of Beta Solutions at OppenheimerFunds, also showed that a recent TIAA survey of affluent investors revealed 90% of millennials are more interested in responsible investing, compared to 73% of other generations. Additionally, about 91% of millennials want to work for an employer that makes a positive social impact in the world, and 90% want their investments to deliver competitive returns while promoting social and environmental outcomes.

“Wealthy millennials have a strong interest in sustainable investing, which includes impact investing, ESG and SRI,” Dane said. “But their interest often exceeds their knowledge.”

This leaves the investment industry an opportunity to further educate and potentially attract interest from this rising group of investors.

As investors consider the untapped potential of sustainable investing, French pointed out that sustainable investments can be broken down to three commonly viewed approaches, including exclusionary screening that avoids investments in certain stocks or industries based on ethical guidelines; ESG that integrate environmental, social, and governance factors into fundamental analysis; and impact investing or investments in projects and companies with express goals of social or environmental changes.