By Joe Mallen and Chris Shuba of Helios Quantitative Research

The other day I was telling my daughter the story of the boy who cried wolf. As the story goes, a little boy would keep fooling the villagers that a wolf was stalking their herd of sheep… until one day a real wolf came along and no one believed the boy’s cries for help. I’m pretty sure the story ended poorly for the little boy. That story reminds me a bit of today’s equity marketplace.

It seems most investors over the years have simply become desensitized to the volume of squawking news headlines. In more recent days, despite economic policy stories that usually cause market trepidation – such as healthcare reform (or lack thereof), the debt ceiling debate, and short term interest rate hikes to name a few – the US equity market has trended to very low levels of volatility. So, why do some investors say this environment feels so volatile, but traditional measures of volatility remain historically low?

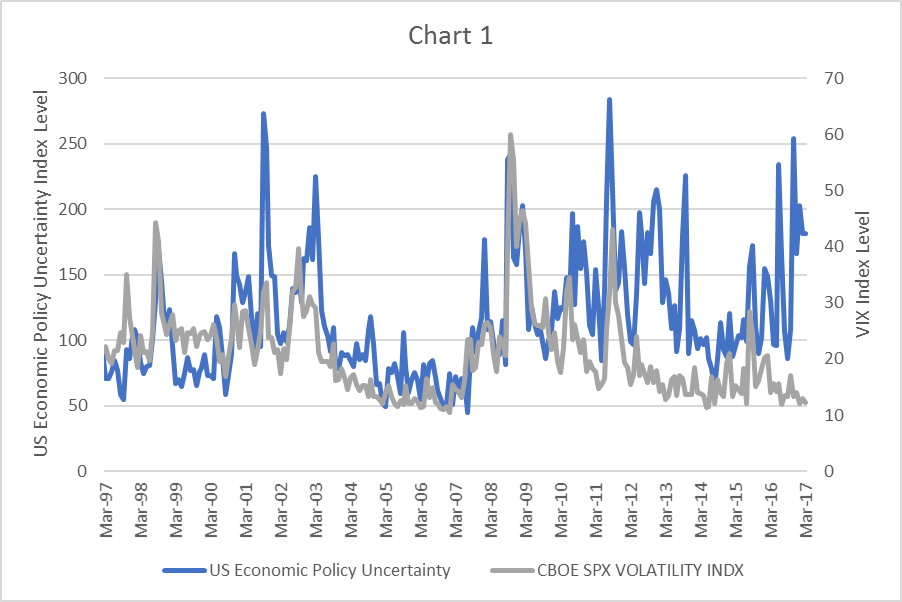

An interesting measure of this “feeling” or general atmosphere is the Baker, Bloom and Davis news-based index of economic policy uncertainty for the US. The index is based on the frequency of newspaper references to policy uncertainty. Likewise, a commonly used gauge of US equity market volatility and investor sentiment is the VIX index. The VIX measures the implied volatility of the S&P 500 in the near term as derived by the market participants in the 30-day options market.

As one would expect, the two indices have historically exhibited high correlation to one another. As headlines detail uncertain policy, the markets tend to translate that information into implied market volatility. Chart 1 shows the historical relationship between the two.

Source: Bloomberg, Helios Quantitative Research