By Michael Jones, RiverFront Investment Group

Although this Strategic View is devoted to emerging markets, Sunday’s French elections are too important for us not to provide a preliminary assessment of the potential impact on financial markets. For the first time in several elections, political polls were correct in forecasting that Emmanuel Macron and Marine Le Pen would advance to the runoff stage of the French presidential election.

A last minute surge by extreme leftwing candidate Jean-Luc Melenchon raised fears that two anti-euro candidates (Le Pen and Melenchon) could be vying for the French Presidency. Instead, the pro-euro Macron secured an outright victory in the first round, and current polls give him a commanding lead over Le Pen in the runoff election. Global financial markets are likely to breathe a sigh of relief with these election results – equity markets, interest rates and the euro are likely to move higher, in our view. Our portfolios are positioned with the expectation of a positive reaction to these election results. We will evaluate the market reaction and provide further commentary on the French election’s potential impact on our overall portfolio strategy.

China’s Problem – Overdependence on Real Estate Investment

Since the financial crisis of 2008, global financial markets have been highly sensitive to growth trends in China. This dependence upon Chinese growth has contributed to financial market volatility over the past several years, especially in emerging equity markets, as China cycled between stimulating growth and then withdrawing that stimulus. We believe that China’s “One Belt/One Road” initiative (also known as the “New Silk Road”) has the potential to break the cycle of alternating acceleration and deceleration in the Chinese economy, and this massive spending program could provide a few years of relative stability for the rest of the emerging markets.

We believe that China’s “accelerate/decelerate” pattern of growth in recent years has been caused by the Chinese economy’s overdependence upon real estate investment. China’s ability to drive growth through ever increasing exports ended with the financial crisis of 2008 and resulting global recession. China reacted to the loss of exports as a growth driver by aggressively stimulating its real estate markets. Real estate buyers were enticed by reduced down payment requirements and lower interest rates, while real estate developers benefited from government mandates that state-owned banks provide ample credit for new real estate projects on attractive terms.

These aggressive stimulus policies eventually create significant imbalances in the Chinese economy. Smaller, “third tier cities” are plagued by overcapacity and “ghost cities” of unoccupied housing projects. Larger cities, by contrast, experience potentially dangerous increases in real estate prices and escalating fears of a real estate market bubble. The consequences of these imbalances are compounded by escalating debt burdens, an inevitable consequence of these borrow and build stimulus policies.

In response to these concerns, the Chinese government periodically withdraws its real estate stimulus efforts. Down payment requirements are increased and banks are instructed to stop lending aggressively to real estate projects. This creates a deceleration in Chinese growth and a China growth scare that is particularly painful as it resonates across smaller emerging economies dependent upon Chinese demand. Eventually real estate activity drops enough to cause China’s leadership to worry about economic growth falling short of highly publicized targets. At that point, real estate stimulus efforts are resumed and the cycle starts over again.

The chart below calculates housing price changes in the 100 largest Chinese cities over the past decade, and clearly illustrates three distinct accelerate/decelerate phases that the Chinese economy has endured over the past 10 years. The cycle works by China reacting to slowing economic growth through major real estate stimulus programs (2009, 2013,2015/2016). This stimulus gets home prices, real estate investment and overall economic activity back on an upward trajectory. As major city real estate prices rise to the point that a bubble is feared (2010, 2012, 2014 and probably 2017) stimulus efforts are withdrawn. Absent government stimulus efforts, real estate prices plunge along with real estate investment, and the overall Chinese economy slows. Slowing growth prompts renewed stimulus efforts, and the cycle begins again.

Source: Factset Research Systems; RiverFront Investment Group.

Based on the alarming 18.9% rise in major city real estate prices witnessed over the past year, we expect China to once again take its foot off the accelerator in 2017 and withdraw real estate stimulus policies. Indeed, we are already seeing increased down payment requirements in China’s largest cities. Historically, we would also be preparing our portfolios for another downturn in the China economy and a potential ripple effect across the other emerging markets. However, we believe that China’s One Belt/One Road program can potentially replace real estate investment as a source of economic growth. If that happens, then the Chinese economy could, at least temporarily, break free from the “on again/off again” growth pattern of the past 8 years.

China’s Solution – the Biggest Infrastructure Spending Binge in History

In 2014, Chinese President Xi Jinping announced a staggeringly ambitious new foreign policy and economic investment initiative, the One Belt/One Road (or New Silk Road) initiative. The goal of One Belt/One Road is to better connect China with the rest of the global economy through specific infrastructure projects, including enhanced port facilities for shipping lanes and new highway and high speed rail connections for overland routes. New infrastructure projects are intended to connect China north into Russia, south into Southeast Asia and west across Central Asia and Europe all the way to the Atlantic coast. In addition to opening new markets for Chinese products, One Belt/One Road is being marketed as a way for places like Pakistan and Uzbekistan to potentially enjoy an economic explosion similar to the one China has experienced over the past 20 years.

The planned scale of One Belt/One Road is unprecedented, with even America’s post-World War II Marshall Plan paling by comparison. Although the plan initially encountered resistance and roadblocks, new projects have been coming on line fairly rapidly over the past several months and approximately $1 trillion in One Belt/One Road projects are currently under construction. According to a McKinsey report[1], China hopes to eventually scale the program up to an annual expenditure of $2-3 trillion and intends to maintain this level of expenditure for several years. To put that into perspective, President Trump is targeting an infrastructure plan of around $1 trillion, and that $1 trillion expenditure is expected to be spread out over a 10 year period.

One Belt/One Road is likely to cause China’s debt levels to rise even faster due to the extraordinary levels of borrowing called for under the plan. However, the assets underlying these debts have the potential to be more productive than the real estate speculation that has previously characterized China’s stimulus efforts. Whether productive or not, China’s printing press and captive banking system all but ensure that Xi will be able to borrow the funds necessary to implement his New Silk Road vision.

Strategic Implications of One Belt/One Road

From the perspective of RiverFront’s portfolio management strategies, we do not have to guess whether the New Silk Road will revolutionize the global economy by enhancing growth prospects in struggling parts of the world. Such a long-term positive outcome is a possibility, but so is the prospect that China is building the infrastructure equivalent of the ghost cities we have seen in the Chinese hinterland. There will be plenty of time to evaluate how effectively these trillions of dollars have been deployed and the potential long-term impact on global economic growth. At the moment, all we seek to understand is the short-term impact that this multi-trillion dollar initiative is likely to have on the Chinese economy and the rest of the emerging markets.

President Xi, through One Belt/One Road, has created an almost limitless ability to stimulate the China economy through borrow and build strategies, in our view. When China builds infrastructure projects, Chinese firms supply all engineering and construction services, and Chinese companies tend to supply all steel, concrete and other manufactured construction inputs. In many instances even the construction workers are flown in from China. Thus, One Belt/One Road projects directly stimulate the Chinese economy no matter where the actual construction takes place. However, unlike borrowing and building in Chinese real estate, we do not think One Belt/One Road projects will create the same imbalances in the Chinese economy. China may, therefore, be able to provide more consistent economic stimulus and avoid the periodic growth scares that have plagued China and the rest of the emerging markets in recent years.

We believe that China needs to hit the brakes on its current real estate stimulus programs in response to dangerously high prices in its major cities. However, thanks to One Belt/One Road, we may not see the deceleration in growth that the Chinese economy has typically experienced in recent years when real estate stimulus has been withdrawn. China can offset its decelerating real estate markets with an acceleration of its New Silk Road spending initiatives. For the next few years, we believe that this new source of borrow and build stimulus can help keep growth hitting government targets even as domestic real estate investment slows.

We also believe that the One Belt/One Road initiative could have positive short-term implications for the rest of the emerging markets. China buys raw materials from Southeast Asia and Latin America and sources component parts and machine tools from Korea and Taiwan. As a result, healthy growth in China tends to stimulate growth across all emerging economies. If One Belt/One Road allows China to avoid yet another growth scare as real estate stimulus is withdrawn, then both economic growth and equity prices in emerging markets could be more reliably positive over the next few years, in our view.

Conclusions

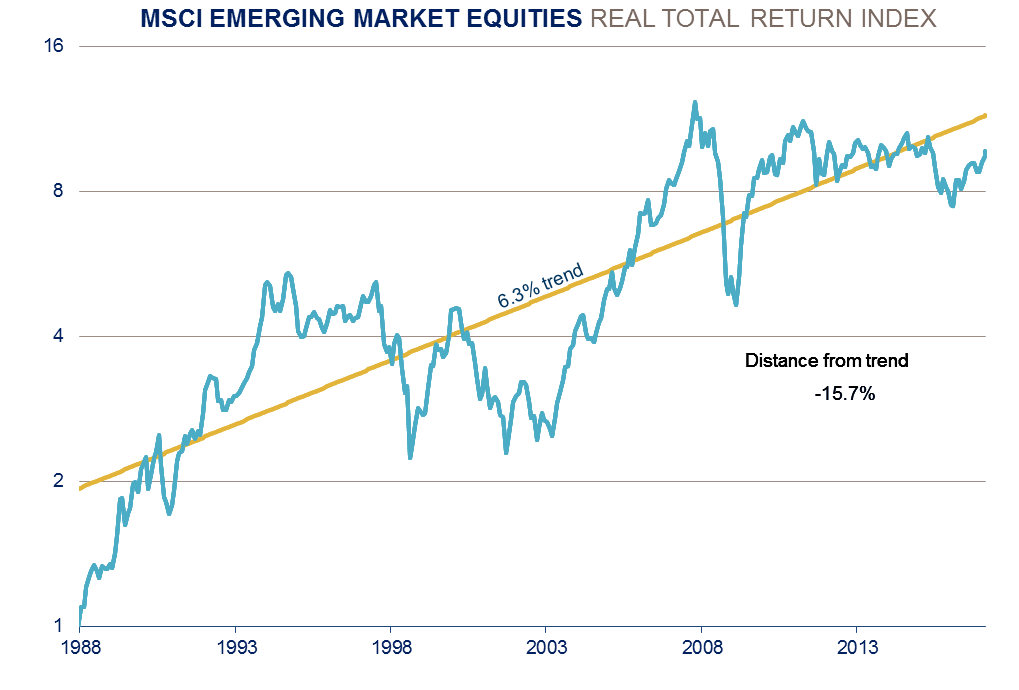

Based on our Price Matters® framework, emerging markets still appear to have relatively attractive valuations, at about 15%-16% undervalued on our distance from trend measure. Emerging markets have a shorter track record and are more volatile than other equity markets, so we typically place an uncertainty penalty on expected returns from this volatile asset class. Despite this penalty and strong price appreciation over the past year, expected returns for emerging market equities remain relatively attractive based upon our Price Matters® framework. If China is a more reliable source of growth for these economies, then we believe that emerging markets can continue the record of strong performance they have established over the past year.

This article was written by Michael Jones, CFA, Chairman and Chief Investment Officer at RiverFront Investment Group, a participant in the ETF Strategist Channel.

[1] McKinsey Podcast, “China’s One Belt, One Road: Will it Reshape Global Trade?”, July 2016, available online at http://www.mckinsey.com/global-themes/china/chinas-one-belt-one-road-will-it-reshape-global-trade.

Source: RiverFront Investment Group, MSCI. Data from Jan 1988 through Feb 2017. Past performance is no guarantee of future results. It is not possible to invest directly in an index. The MSCI Emerging Markets Index measures equity market performance of emerging markets. The Index consists of 21 emerging market country indices.

Important Disclosure Information:

Past results are no guarantee of future results and no representation is made that a client will or is likely to achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Strategies seeking higher returns generally have a greater allocation to equities. These strategies also carry higher risks and are subject to a greater degree of market volatility.

RiverFront’s Price Matters® discipline compares inflation-adjusted current prices relative to their long-term trend to help identify extremes in valuation.

Diversification does not ensure a profit or protect against a loss.

Investing in foreign companies poses additional risks since political and economic events unique to a country or region may affect those markets and their issuers. In addition to such general international risks, the portfolio may also be exposed to currency fluctuation risks and emerging markets risks as described further below.

Changes in the value of foreign currencies compared to the U.S. dollar may affect (positively or negatively) the value of the portfolio’s investments. Such currency movements may occur separately from, and/or in response to, events that do not otherwise affect the value of the security in the issuer’s home country. In addition, the value of the portfolio may be influenced by currency exchange control regulations. The currencies of emerging market countries may experience significant declines against the U.S. dollar, and devaluation may occur subsequent to investments in these currencies by the portfolio.

Technical analysis is based on the study of historical price movements and past trend patterns. There are no assurances that movements or trends can or will be duplicated in the future.

RiverFront Investment Group, LLC, is an investment adviser registered with the Securities Exchange Commission under the Investment Advisers Act of 1940. The company manages a variety of portfolios utilizing stocks, bonds, and exchange-traded funds (ETFs). RiverFront also serves as sub-advisor to a series of mutual funds and ETFs. Opinions expressed are current as of the date shown and are subject to change. They are not intended as investment recommendations. Any discussion of the individual securities that comprise the portfolios is provided for informational purposes only and should not be deemed as a recommendation to buy or sell any individual security mentioned.

Copyright ©2017 RiverFront Investment Group. All rights reserved.