S&P 500 financial companies are currently trading at the greatest discount to the broader market, reflecting their cheap valuations. Additionally, banks and insurers are also paying out some of the lowest dividends, which leaves them more room to grow their payouts in the years ahead.

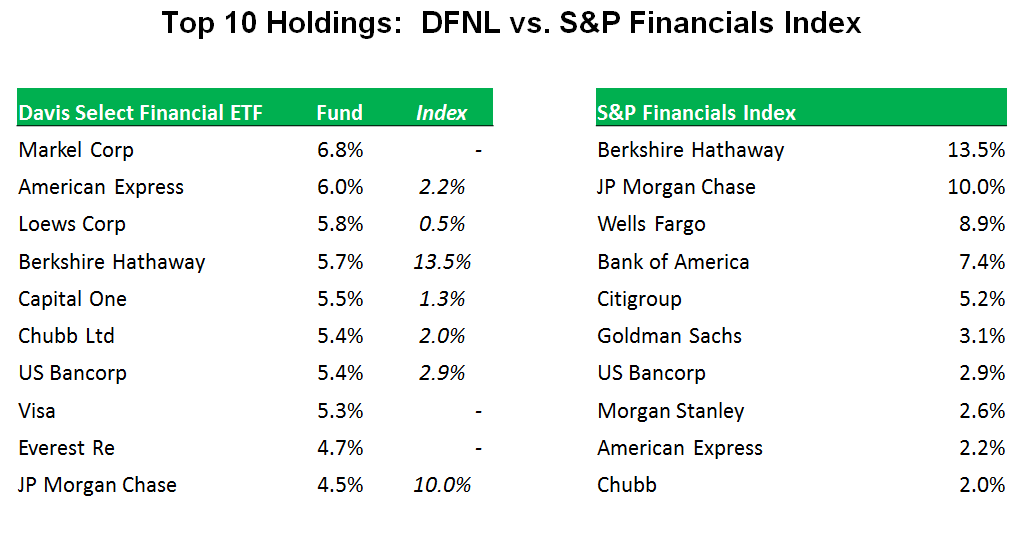

Davis mentioned a number of compelling company names given these three factors, including Goldman Sachs, J.P. Morgan Chase, Wells Fargo, American Express, Chubb, BNY Mellon and US Bank, which can be found in the actively managed Davis Select Financial ETF (NasdaqGM: DFNL).

Davis Advisors’ preference for the financial sector is also reflected in the other active Davis Select U.S. Equity ETF (NasdaqGM: DUSA), which includes 38.0% financials.

Overall, an active manager may be better positioned to adapt to a changing market environment, especially in an aging bull market where any small thing could pause the forward momentum. In a survey of advisors attending the webcast, 70% of respondents indicated that an active strategy would outperform in 2017. However, active ETFs may continue to find trouble in gaining traction among the investment community that has grown increasingly more interested in low-cost, passive funds, with 44% of respondents indicating that passive ETFs could gather the most assets in 2017, compared to 23% of advisors who think active ETFs will gain the most assets this year.

Davis Advisors’ selection process may also allow investors to gain greater potential. For instance, DFNL includes a greater tilt toward mid-sized companies that are more capable of growth, whereas the S&P Financial Index focuses on the largest financial names.

Financial advisors who are interested in learning more about opportunities in the financial sector in the current market environment can watch the webcast here on demand.