By Confluence Asset Management

In a recent Bloomberg Surveillance podcast, Sebastian Mallaby made an interesting observation about the recent Fed tightening. He noted how the asset markets mostly ignored or cheered the move. Mallaby suggested that this isn’t necessarily a good outcome, meaning that central bank tightening should not be welcomed by the financial markets. When it is, it can make the markets complacent; this is one of the main tenets of Hyman Minsky’s research.

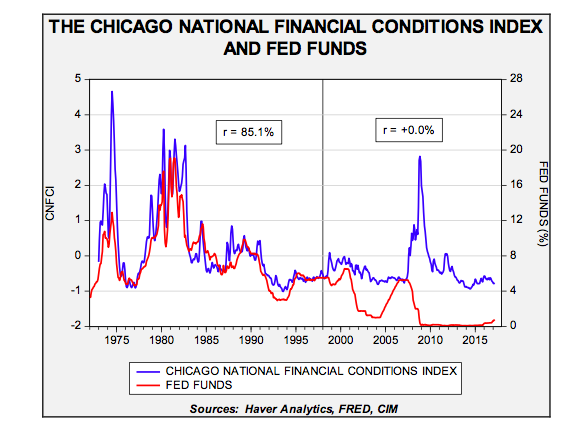

This chart clearly shows how financial markets have changed.

The blue line on the chart shows the Chicago FRB Financial Conditions Index. It measures the level of stress in the financial system. It is constructed of 105 variables, including the level of interest rates, credit spreads, equity and debt market volatility, delinquencies, borrower and lender surveys, debt and equity issuance, debt levels, equity levels and various commodity prices (including gold). A rising line indicates increasing financial stress. The red line is the effective fed funds rate. Until 1998, the two series were positively and closely correlated. When the Fed raised rates, financial stress rose; when the Fed lowered rates, stress declined.

We believe one factor that changed this relationship is policy transparency. Starting in the late 1980s, the Fed became increasingly transparent. Before 1988, for example, the FOMC would meet but issue no statement about what it had decided to do. Investors and the financial system had to guess if policy had been changed. Starting in 1988, the central bank began publishing its target rate. In the 1990s, it began issuing a statement when rates changed; eventually, a statement followed all meetings. As the FOMC has become more transparent, the correlation between stress and the level of fed funds has changed. Essentially, the markets now know with a high degree of certainty when rate changes are likely. This is especially true of tightening. The FOMC appears to avoid making rate hikes that surprise the market.

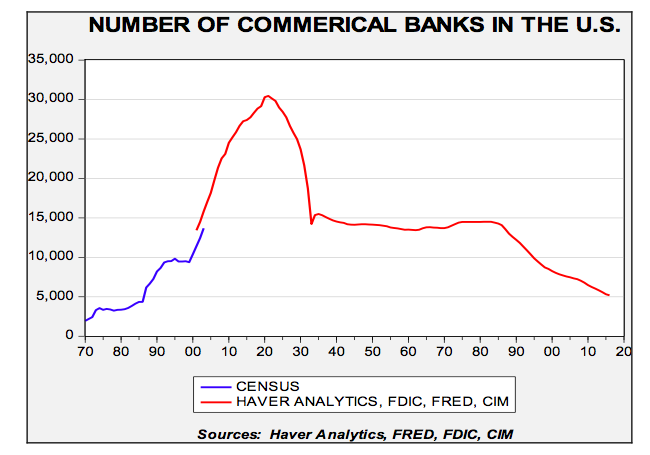

Central bank policy goals are another factor that may have changed the stress/fed funds relationship. Although Congress has specifically tasked the Fed with managing full employment and low inflation, all central banks exist to act as lenders of last resort. Central banks provide liquidity during panics to prevent widespread financial firm failures during crises. For most of the post-Depression period, the financial system was heavily regulated; investment banking and commercial banking were separated by Glass-Steagall, and the Bank Holding Company Act restrained bank operations across state lines. This led to a high number of small commercial banks.

This chart shows the number of commercial banks in the U.S. There is a break in the series around 1905; we have put together a time series from a variety of sources. There was a sharp consolidation of banks during the 1920s into the early years of the Depression. Banking regulation kept the number mostly stable. Financial institution failures show how the financial system stabilized from the mid-1930s into the early 1980s.