By Rusty Vanneman, CFA, CMT and Kostya Etus, CFA, CLS Investments

The most well-known potential benefits of ETFs include:

– Lower costs

– Tax efficiency

– Diversification

– Stable market and risk exposure

– Transparency

– Intra-day trading

– Unique investment options

But, there are a few more advantages that sometimes get overlooked. For example, the ability to buy certain ETFs at no charge at retail brokerage firms. These ETFs are known as No-Transaction-Fee (NTF) ETFs or commission-free ETFs. In this blog, we will explore the idea behind NTFs, compare and contrast some of the brokerage platforms that use them, and evaluate how the lineup of available NTFs may evolve in the future. The bottom line is that NTF ETFs, all else being equal, should have higher expected returns than ETFs that require commission to buy or sell.

No-Transaction-Fee Landscape

A retail brokerage firm typically makes the majority of its revenues from trade commissions. In turn, these firms love day traders! Individual stocks, traditionally the most popular tools for day trading, cost investors around $10 to buy and an additional $10 to sell. But, retail brokers don’t want to put all of their eggs into one basket in terms of revenues, so they are creative with mutual funds, which are typically used for buy-and-hold strategies. A fund sponsor can “pay-to-play” for access on a brokerage platform, and a share of its own revenues can be offered with no commission cost (this is also called “no-load” for mutual funds). Many mutual funds have gone this route, and the lineups for NTF mutual funds have grown to be quite extensive. Of course, investors will not gain access to the cheapest share class for an NTF fund (after all, they have to pass forward some of their revenue to the brokerage firm), so they would need to consider the expected holding period and size of their investments.

Income ETFs trade like stocks, and some trade much tighter than the spreads of their underlying securities, so they are favorites for day traders. But, there are a couple of unique factors to consider with income ETFs. First, due to their broad, diversified (mutual-fund-like) exposures, they are often used for longer-term holdings. Thus, they attract a wider audience, and perhaps evoke less concern over commissions. Second, ETF issuers are very eager to see liquidity in their new funds grow as quickly as possible as this tends to be one of the largest hindrances to purchasing an ETF for many investors. As liquidity improves, asset growth typically follows. The best way to boost daily flow is to have it trade frequently, regardless of trade size, which is exactly what happens on retail brokerage platforms.

ETF issuers strive for that NTF status. Yet, out of around 2,000 ETFs in existence, only about 100 to 200 ETFs are NTF on each platform. Why so few? First, it’s expensive for the ETF issuers. A brokerage firm is missing out on a lot of revenue by not charging a commission on an ETF. Revenue sharing is more painful for ETF issuers because ETFs are typically priced at lower expense ratios. Second, many of the platforms have early redemption fees for buyers of NTF ETFs (i.e., a client would have to hold the ETF for 30 days before selling to avoid a fee). This helps prevent the day trading notion for NTF ETFs, putting a road block on the liquidity ETF issuers are looking for.

Commissions are an Overlooked Expense

All else equal, a commission charge represents an additional expense for owning an ETF, and thus, an NTF ETF should be preferred. After all, expected returns for investors are based on all costs involved, including the expense ratio, bid-ask spread, market impact cost (how much a price moves based on a trade), and brokerage commission.

The benefit of an NTF ETF depends on the trade size. If an institutional manager trades $1 million, a $10 charge is not much of an expense on a percentage basis at 0.001%. But, if a retail client trades $1,000, the commission charge becomes 1.0%, which has a significant impact on an investment’s return. And, of course, investors get dinged again when they sell.

In an industry where investors have to fight for every basis point of returns, commissions definitely matter and should not be overlooked as a factor impacting expected returns.

Brokerage Comparison

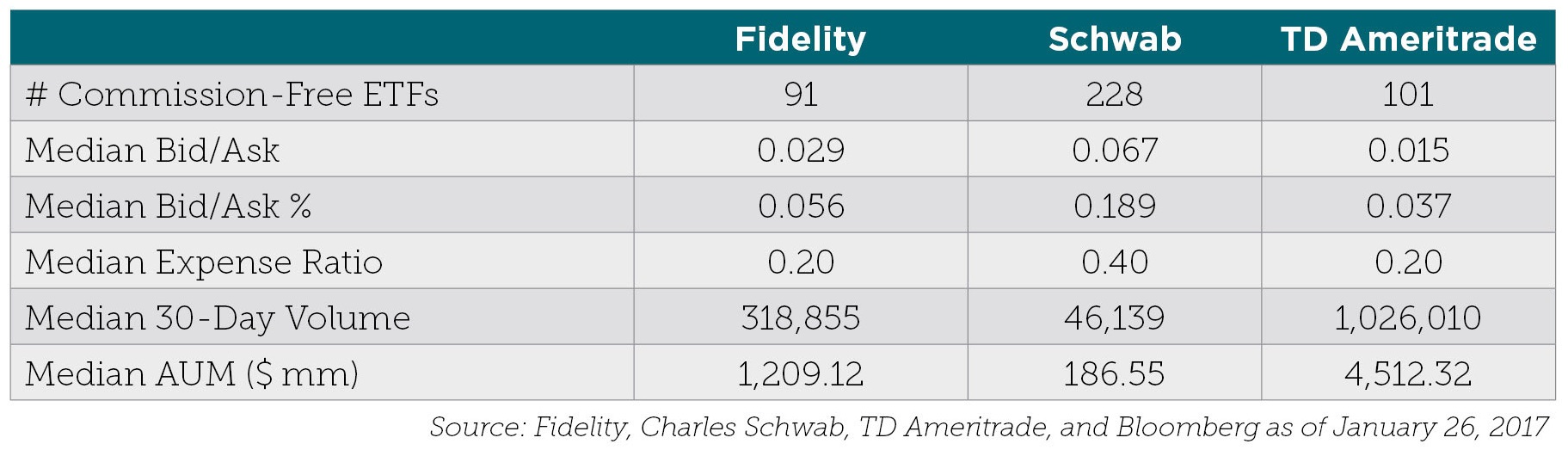

Below is a comparison of NTF ETF offerings from three of the larger brokerage firms: Fidelity, TD Ameritrade, and Charles Schwab.

Fidelity

– Fidelity currently has the lowest number of NTF ETFs with 91, but as the firm launches ETFs, they are added to the lineup.

– The lineup is comprised of only two providers: iShares, which is fairly diversified, and Fidelity, which uses its own ETFs (a great way to promote and grow the proprietary lineup).

– Fidelity charges a $7.95 early redemption fee (online).

TD Ameritrade

– TD Ameritrade has a slightly stronger showing with 101 NTF ETFs currently.

– The firm is more diversified; it has nine providers utilizing Morningstar as an advisor for the selection and evaluation of the lineup.

– TD Ameritrade charges a $19.99 early redemption fee.

Charles Schwab

– Charles Schwab has the strongest lineup currently of 228 NTF ETFs, and the strongest growth in offering over time.

– It is well diversified; it has 16 different ETF issuers, which also utilize its Schwab ETF lineup.

– Schwab has no early redemption fee.

Fully evaluating the lineups of these firms goes well beyond the count. At CLS, we evaluated the quality of the products available in terms of liquidity and expense. Unfortunately, there has not been a tremendous amount of change in recent years. TD Ameritrade has not adjusted its lineup of NTF ETFs in several years, but it does have the most liquid offering and lists lower expense funds. Fidelity expanded its offering by including its own ETFs after they launched, but there has not been much change since then. It is second in terms of liquidity and matches TD with the attractive median expense of 20 basis points. Schwab has recently removed about a dozen ETFs, but has shown the most growth over time and is quite dominant in the total number. But, in terms of liquidity, cost, and asset size, Schwab is far less liquid and twice as expensive as the competition.

One interesting note is, liquidity and size have improved on the platforms over time. The lineups haven’t changed much, but the ETFs have grown and become more liquid. This is partly due to the general growth in ETFs, but studies have shown that listing ETFs as NTF on these platforms has improved liquidity and size. Thus, potentially tighter trading spreads on NTF ETFs is an additional cost savings for utilizing them.

Looking to the Future

One thing that all-inclusive vacation resorts have taught us is people love getting things for free. Why pay money for something when you can get something similar for free? This is the leading driver of NTF ETFs, but the limited lineups do create some issues. Investors may be buying certain funds simply because they are NTF with less regard to the specifics of the underlying exposures (arguably a lot more important). Thus, brokerages have an important duty to offer a well-diversified (many choices) and cost-conscious (liquid) lineup that stays on top of new options as they come to market.

Instead of focusing on how much revenue an issuer can generate and avoiding the inclusion of competitor products, brokerage firms should shift their focus to investment advisors and what exposures, liquidity and size they may be looking for. Finding these answers will help develop and evolve a lineup that helps all investors achieve their long-term investment goals.

In summary, NTF ETFs are an important addition to brokerage platforms as they reduce the costs associated with investing in ETFs, and thus, result in higher expected returns. While NTF ETF lineups got off to a great start, their growth has slowed in recent years. The increase in NTF options on various platforms will continue to promote ETFs in the industry, which will be mutually beneficial for all brokerages, issuers, and investors.

Rusty Vanneman is the Chief Investment Officer at CLS Investments, a participant in the ETF Strategist Channel.

Disclosure Information

This information is prepared for general information only. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. 2197-CLS-2/3/2017