If that historical average gain is realized, it targets 2470 on the S&P 500 in mid-July. In addition, within the context of secular bull markets, weak years (defined by an S&P 500 total return of 5% or less) have historically been followed by two years of strength. In secular bull market periods dating back to 1946, there have been nine years prior to 2015 with gains of 5% or less. The subsequent gain over the next two years has averaged 49.4%.

In 2015, the S&P 500 posted a total return of 1.4%, which qualifies as a weak year. If history repeats this trend, the S&P 500 could have a surprisingly strong year in 2017. For example, the S&P 500 gained a total return of 11.95% in 2016. To reach the historic two year average of 49.4% referenced above, the S&P 500 would need to post a 33.5% gain in 2017. Now we don’t expect the market to achieve those types of gains, but these historic trends help to underscore the positive backdrop for the equity markets.

Risks In the market Outlooks that we have done over the past two years, we have said that “Our single biggest concern continues to be stretched valuations.” Well, here we are again and we can say the same thing. But a year later in the bull market, there are additional concerns including the age of this bull, geopolitical risks from the rise of Populist movements across Europe, the Middle East immigration crisis, and now, for the first time in over a decade, the real threat from rising interest rates.

On the valuation front, the median P/E ratio for the S&P 500 is 22.9, which is near the upper end of its range excluding the late 1990s/early 2000s bubble. Interest rates and multiples tend to be inversely correlated, so multiples could contract if the Treasury yield climbs toward 3%, which is our upside target for yields over the intermediate term.

Valuations can and have remained stretched for extended periods so they are not timing tools, but more of a measure to assess potential risks. Our conclusion is the same as it was for the past two years, stretched valuations don’t necessarily mean that a bear market is imminent, but they do place increased importance on earnings growth. And fortunately the earnings recession of last year is over. Earnings declined for six consecutive quarters with earnings turning positive again in the third quarter of 2016.

With valuations and multiples stretched, the market needs earnings growth to support the expensive valuations. Earnings growth is expected to be in the low single digits for the fourth quarter of 2016 but to jump into the double digits in the first and second quarters of 2017. For all of 2017, current estimates project S&P 500 earnings growth to be very solid at 12.3%. That would be very supportive for the market. We think there is potential for an upside surprise affecting even these earnings expectations based on the accelerating economic growth and corporate tax reform, which is not currently reflected in the consensus numbers.

Earnings are in the sweet spot for the market having turned up following a six quarter decline and are set for solid growth. Earnings growth is an offsetting factor to the valuation concerns. Margin debt is another risk that bears watching. Margin debt is a reflection of speculative excesses that often develop late in a bull market. As a percentage of GDP, margin debt hit an all-time high in April 2015 and has since contracted.

This is something we have been watching, looking for clues that the bull run is beginning to wane, since past peaks in margin debt have occurred near market tops. However, for now, margin debt has rebounded with the market but it so far has failed to surpass the previous peak and therefore remains a concern that we are monitoring closely.

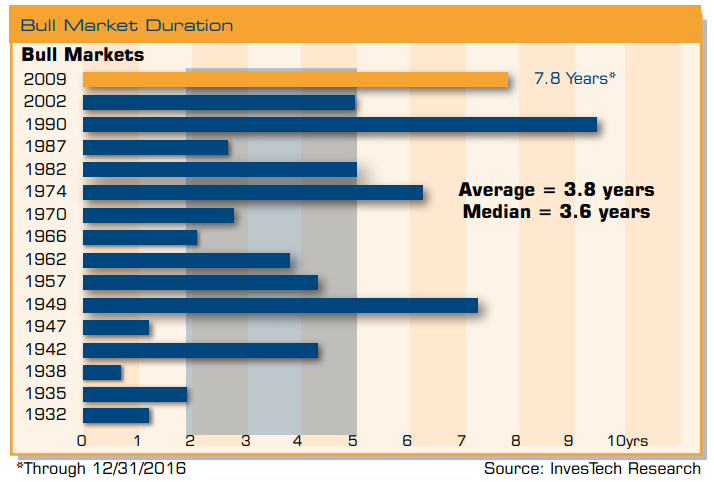

The S&P 500 has now been up on a total return basis for eight straight years and we have been mostly bullish over that span. The all-time record for consecutive up years is nine (1991—1999), so another year of gains would tie that record. That helps underscore one of the risks of this aging bull. This is now the second longest bull market since 1932, only the bull market of the 1990s was longer. We have said many times over the past couple of years that bull markets don’t typically die of old age, but at the same time, a longlived bull market can be a risk that bears close scrutiny.

Fixed Income Inflation is a growing concern for the Fed but they still may be underestimating what lies ahead. Fed officials currently expect core inflation for personal consumption expenditures to remain below their 2.0% target until late 2018. Yet emerging evidence and leading inflation indicators paint a different picture. While Core CPI has been relatively stable at 2.1% over the past year, the Future Inflation Gauge from the Economic Cycle Research Institute moved up to an eight-and-a-half-year high and the Ned Davis Research Inflation Timing Model is in a solid uptrend. Both of these indicators point to inflation pressures building, in addition to the wage pressures we discussed earlier.

As we observed before, the Federal Reserve seems to be behind the curve with upside risks to inflation. The latest comments out of the Fed are somewhat at odds between letting the economy “run hot” and setting expectations of three additional rate hikes in 2017. However, if recent history is any guide, the Fed will fall short of hiking rates as often as they suggest given that they only hiked rates once in each of the past two years. We expect the Fed to hike rates twice in 2017.

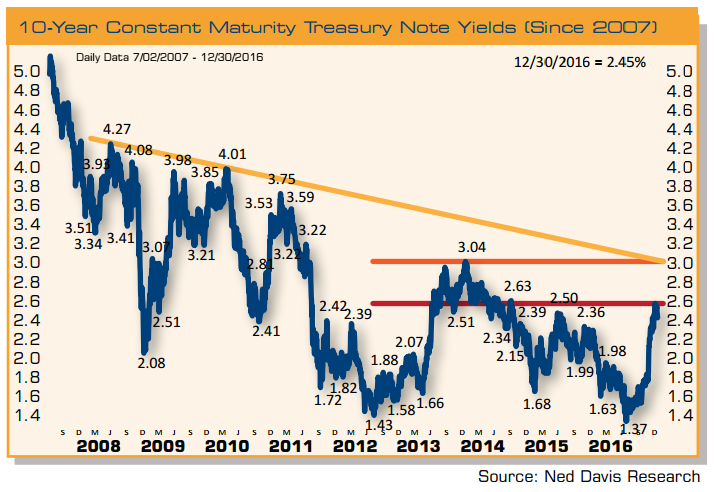

However, in our opinion, it is not how many times the Fed raises rates that is most important, but what the Federal Reserve Board looks like over the next couple of years. Janet Yellenwill not be reappointed as Fed Chair when her term expires on January 31, 2018. Trump will have an incredible opportunity to shape the Board of Governors. In addition to nominating a new Chair, he will fill at least two other vacancies on the board. The 10-year Treasury yield surged from a post-Brexit low of 1.36% to a post-Trump victory high of 2.60%, rising nearly 125 bps. The 10-year yield ended 2016 at 2.45%. Essentially the 10-year Treasury yield made a round trip with the journey beginning with a 100 bps decline early in the year, followed by a Trump election victory surge.

Our expectation is that the pace of the backup in yields will slow as widespread pessimism among bond investors is now evident. As a result, we may witness this current area holding for the moment as yields consolidate. Our intermediate-term stance is that we will see the 3.0% level on the 10-year Treasury Note, which represents the January 2014 high, and in our opinion, that level is key to the long-term outlook. While 3.0% is our intermediate-term upside target for yields, we think yields could back off that level and we have a yearend target of 2.75%.

Our long-term view on interest rates is that the low is in and a new secular bear market has begun. However, that does not mean that fixed income investors are doomed to experience losses. History suggests quite the opposite. For example, the 10-year Treasury yield has risen in 19 of the 41 years since the inception of the Barclays Aggregate Bond Index.

In 16 of those years, or 84% of the time, the Aggregate Bond Index gained as rates rose. In addition, yields rose in 13 of the 33 years since the inception of the Barclays High Yield Index. High yields rose in 10 of the 13 years, or 77% of the time, and the average gain in those years was 11%. In addition, yields rose in 16 of the 37 years since the inception of the Barclays Municipal Bond Index. Muni bonds rose in 11 of the 16 years, or 69% of the time that rates were rising. Finally, using the Barclays Aggregate Bond Index since its inception, only 1% of the total return has been from price appreciation, 16% of the index total return has been from coupons, and a staggering 83% of the index return has been from reinvesting coupons.

This is why higher rates are not entirely bad, higher rates often mean higher coupons and more reinvestment income. In our Outlook last year, we stated that “High yield bonds have one of the best risk-adjusted return profiles.” High yield bonds certainly did turn in great performance in 2016 with the Barclays High Yield Index up 17.13%. In a highly anticipated and telegraphed move, the Federal Reserve hiked interest rates for only the second time in over a decade during the fourth quarter and, leading up to the event, there was some fear and trepidation about the impact that any rate hike would have on the fixed income markets. So far this time, as with the rate hike in 2015, there has been no real negative impact on the markets. We have often said that we believe high yield would outperform in rising interest rate environments.

Over the past 23 years, there have been seven instances where the 10-year Treasury yield has risen by over 100 bps. In each one of those cases, high yield bonds posted positive total returns while Treasuries were lower across the curve. The current case, now the eighth time rates have risen by at least 100 bps, is no exception.

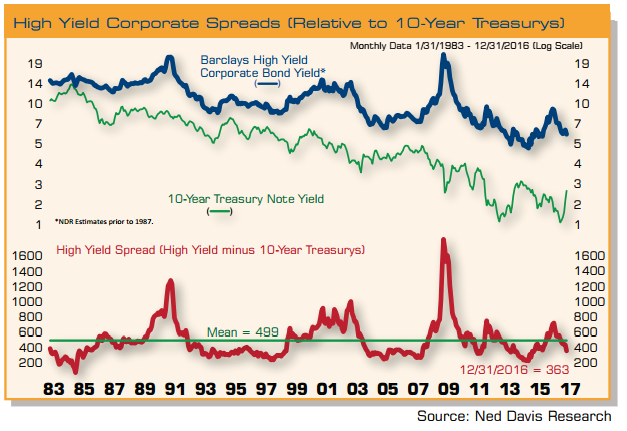

The 10-year Treasury yield bottomed on July 8th at 1.36% and so far has risen to a high of 2.60% on December 16th, rising nearly 125 bps. From that point to the end of the year, the Barclays 7-10 Year Treasury Index was down 6.96% while the Barclays High Yield Index was up 5.93%, outperforming Treasuries by 1289 bps. High yield credit spreads have fallen from a peak of 840 bps in February to 363 bps at yearend.

The only times in which high yield bonds as an asset class traded at a higher spread to U.S. Treasuries than this past February was in the recession of 1990, the early 2000s, and the 2008-2009 credit crisis. Further, the only time that high yield spreads came close to the same level as on February 11th in a non-recessionary environment was during the U.S. debt downgrade in 2011. In each of these examples, once spreads contracted they stayed low for several years.

It is unlikely that we will see the same surge in credit this year as we saw in 2016, but with little chance of recession over the next 12 months and higher interest rates coming, we continue to overweight credit. We enter 2017 favoring high yield, as history shows that spreads can remain tight for a long period of time without an economic downturn.

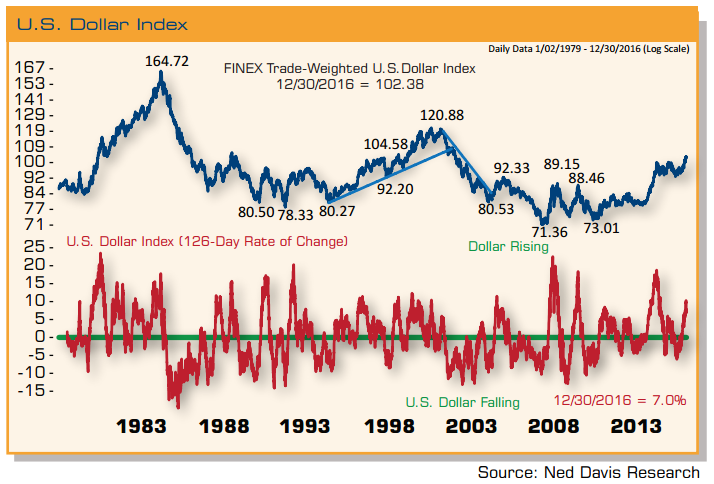

Additionally, higher inflation means a reduced probability of default, and historically, higher inflation expectations have correlated with falling credit spreads. U.S. Dollar The trade-weighted U.S. dollar gained 3.6% in 2016, but that only tells part of the story.

The dollar traded in a large sideways consolidation pattern from March 2015 until breaking out to the upside just after the presidential election. The dollar has gained 10.4% since hitting its low of that consolidation in May. As the Fed continues along its tightening cycle, the dollar will likely continue to rally and that will have economic implications here in the U.S.

A general rule of thumb is that each 10% move in the dollar is about the equivalent of a 1% hike in the Fed Funds rate. So a strengthening dollar has a tightening effect, which could be another reason why the Fed may fall short in the number of hikes this year.

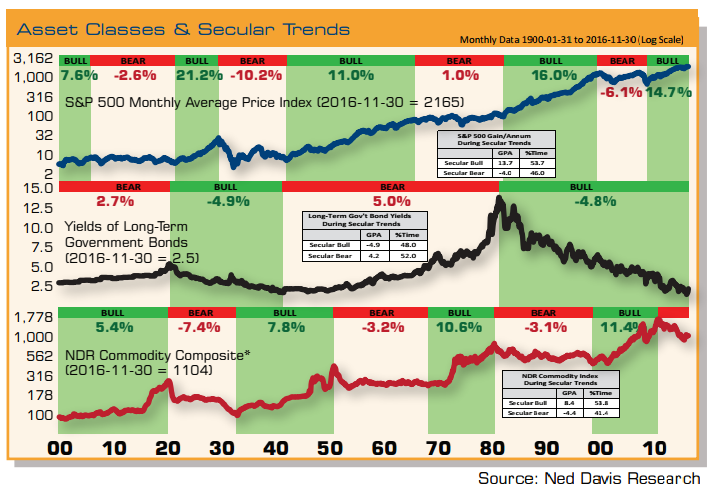

Secular Let’s shift focus and look at the secular trends. We like to keep the secular trend in focus as it helps to put the short-term environment into its proper perspective. This chart shows asset classes and secular trends. Stocks are on top, Treasury yields in the middle, and commodities on the bottom. The shaded green areas represent secular bull markets in each asset class.

The key to this chart is the checkered look and identifying when each asset class is in a secular bull. We can see that when commodities are in a secular bull, stocks are in secular bear, and when stocks are in a secular bull, commodities are in secular bear. Such is the case currently and this reinforces our view. Stocks have risen at a 14.7% average annual rate since bottoming in 2009. We have been highlighting the fact that the next secular trend to come to an end is likely that of bonds. The long-term sentiment in bonds has quickly shifted from lower for longer to too low for too long and the Fed is behind the inflation curve.

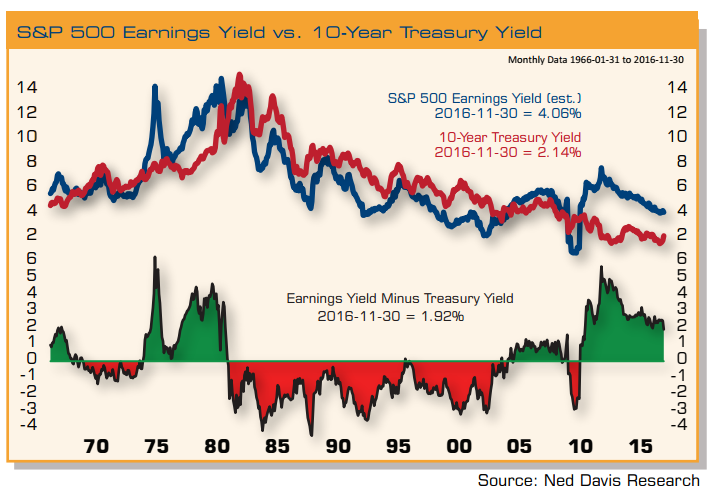

As we mentioned at the outset, our long-term view is that we are in a secular bull market in stocks. While stocks are expensive in absolute terms based on P/E multiples, price to book ratios, and almost any fundamental measure, on a relative valuation basis stocks look cheap compared to bonds. Comparing the relative valuation of stocks to bonds using the S&P 500 earnings yields and the 10- year Treasury yield, stocks are undervalued compared to bonds.

Over the past 10-years, the S&P 500 is up 95% and the Barclays Long Term Treasury Bond Index is up 91%. It is rare for stocks and bonds to have similar returns and even more rare for bonds to outperform stocks over a rolling 10-year period. When it does happen, stocks usually go on to dramatically outperform bonds over the next period. We are just coming off a period when bonds outperformed stocks, and on a 10-year total return basis, stocks are one standard deviation undervalued compared to bonds.

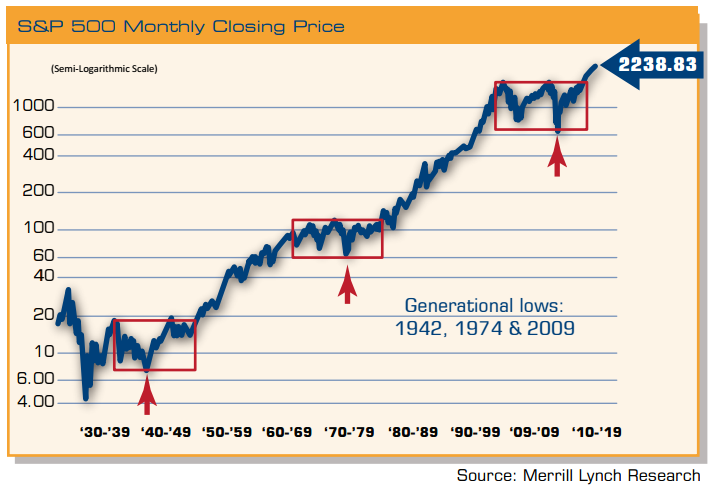

This is a long-term supporting factor in favor of a continued secular bull market in stocks, especially with interest rates now moving higher. As we finish I’d like to look at past secular trends. The three boxes in red highlight the last three secular bear markets. Of note is that once the market eclipsed its prior secular peak, it continued higher for many years. The prior two secular bull runs lasted 22 and 18 years. That is the environment we live in today. Of course there will be cyclical bull and bear markets as always, but the primary secular trend appears to be higher and if history is any guide it has the potential to have some staying power.

In conclusion, we are still in a secular bull market in stocks and have a positive outlook. According to post-election year trends, we should see strength early on with potential weakness in the back half of the year. The economy should accelerate based on progrowth policies and we expect 3.0% GDP growth, while the economic expansion continues through yearend. The secular trends are in favor of stocks while the long-term trend has changed from bull to bear for bonds. Treasury yields are likely to continue rising but at a slower pace. Given the trend change in fixed income, we see the need to really manage risk in fixed income by taking an active and opportunistic approach.

Sean Clark is the Chief Investment Officer at Clark Capital Management, which is a participant in the ETF Strategist Channel

Disclosure Information:

Forward-looking statements are not guaranteed. The discussions, outlook and viewpoints featured are not intended to be investment advice and do not take into account specific client investment objectives. The opinions expressed are those of the Clark Capital Management Group Investment Team. The opinions referenced are as of the date of publication and are subject to change due to changes in the market or economic conditions and may not necessarily come to pass. There is no guarantee of the future performance of any Clark Capital investment portfolio. Material presented has been derived from sources considered to be reliable, but the accuracy and completeness cannot be guaranteed. Nothing herein should be construed as a solicitation, recommendation or an offer to buy, sell or hold any securities, other investments or to adopt any investment strategy or strategies. For educational use only. This information is not intended to serve as investment advice. This material is not intended to be relied upon as a forecast or research. The investment or strategy discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Past performance is not indicative of future results. Clark Capital Management Group, Inc. reserves the right to modify its current investment strategies and techniques based on changing market dynamics or client needs. The information provided in this report should not be considered a recommendation to purchase or sell any particular security, sector or industry. There is no assurance that any securities, sectors or industries discussed herein will be included in or excluded from an account’s portfolio. It should not be assumed that any of the investment recommendations or decisions we make in the future will be profitable or will equal the investment performance of the securities discussed herein. Clark Capital Management Group, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about Clark Capital’s advisory services can be found in its Form ADV which is available upon request. The S&P 500 measures the performance of the 500 leading companies in leading industries of the U.S. economy, capturing 75% of U.S. equities. Barclays 7-10 Year Treasury Index tracks the investment results of an index composed of U.S. Treasury bonds with remaining maturities between seven to ten years. Barclays 20+ Year Treasury Index tracks the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than 20 years. S&P GSCI Index is an unmanaged world production-weighted index composed of the principal physical commodities that are the subject of active, liquid futures markets. S&P GSCI Industrial Metals Index is considered representative of investment performance in the industrial metals market. The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performers of developed markets outside the U.S. and Canada. The MSCI World Index is a freefloat-adjusted market capitalization index that is designed to measure global developed market equity performance. The MSCI World Index ex. U.S. is a freefloat-adjusted market capitalization index that is designed to measure global developed market equity performance excluding the U.S. The Russell 3000® Index measures the performance of the 3,000 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index. The Value Line Arithmetic Composite Index uses the arithmetic mean change in the index reflects change if a portfolio of stocks in equal amounts were held. The S&P MidCap 400 Index measures the performance of mid-sized companies, reflecting the distinctive risk and return characteristics of that market. The S&P Small Cap 600® measures the small-cap segment of the U.S. equity market being designed to track companies that meet criteria showing that they are liquid and financially viable. The VIX Index is a forward looking index of market risk which shows expectation of volatility over the coming 30 days. Barclays U.S. Government/Credit Bond Index measures the performance of U.S. dollar denominated U.S. Treasuries and government-related & investment grade U.S. Corporate securities that have a remaining maturity of greater than one year. The Barclays U.S. Aggregate Bond Index covers the U.S. investment-grade fixed-rate bond market, including government and credit securities, agency mortgage pass-through securities, asset-backed securities and commercial mortgage-based securities. To qualify for inclusion, a bond or security must have at least one year to final maturity, and be rated investment grade Baa3 or better, dollar denominated, non-convertible, fixed rate and publicly issued. The Barclays U.S. Corporate High-Yield Index covers the USD-denominated, non-investment grade, fixed-rate, taxable corporate bond market. Securities are classified as high-yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB+/BB+ or below. The iPath® S&P 500 Dynamic VIX ETN is designed to provide investors with exposure to the S&P 500® Dynamic VIX Futures™ Total Return Index. The S&P 500® Dynamic VIX Futures™ Total Return Index (the “Index”) is designed to dynamically allocate between the S&P 500® VIX Short-Term Futures™ Index Excess Return and the S&P 500® VIX Mid-Term Futures™ Index Excess Return by monitoring the steepness of the implied volatility curve. The Index seeks to react positively to overall increases in market volatility and aims to lower the roll cost of investments linked to future implied volatility. Index returns include the reinvestment of income and dividends. The returns for these unmanaged indexes do not include any transaction costs, management fees or other costs. It is not possible to make an investment directly in any index.