Meanwhile, stable but sluggish global economic growth should combine with strong demand for U.S. Treasury bonds to keep a lid on long-term interest rates at 0.30-0.50% higher than current levels.

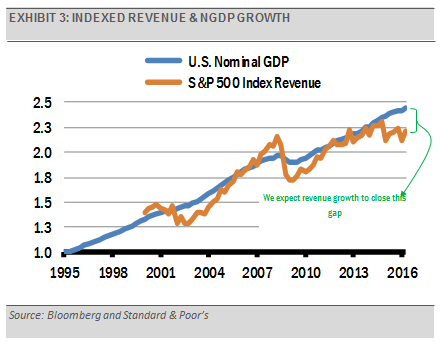

Moving to the broader economy, increased inflation expectations have caused us to raise our forecast for nominal GDP (NGDP) from 3.7% to 4.2%. Our prior forecast already included an increase in productivity from 0.5% to 1.8%, so this expectation does not change much under the new administration’s proposed policy shifts. Instead, we expect increased inflation until the Fed’s tighter monetary policy takes hold.

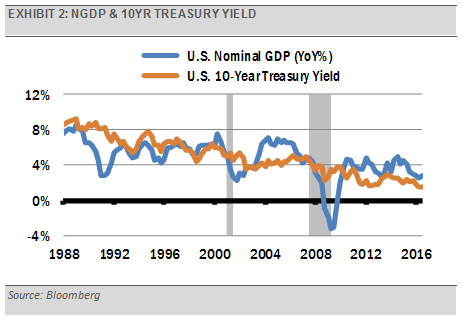

Since 1988, the 10-year Treasury has averaged 0.30% more than NGDP overall, roughly even in non-recessionary environments, and is averaging 1.3% lower than NGDP during the current global low interest rate environment. Combining this with our current NGDP forecast gives us: 4.2%-1.3% = 2.9% as an expectation for the 10-year Treasury yield.

The collision of fiscal stimulus and tightening monetary policy may lead to significant volatility. Economic and market fundamentals remain strong, so we view equity market volatility and declines in this context as buying opportunities. Higher nominal GDP has implications for higher corporate revenue and earnings growth, which we have been saying for months that we expect to accelerate. Higher revenues and increased earnings can support higher stock prices going forward.

In short, we think the U.S. economy will continue to grind forward but uncertainty revolving around the struggle between fiscal stimulus and the Fed’s mandate of keeping inflation contained will result in increased market volatility.

Gary Stringer is the CIO, Kim Escue is a Senior Portfolio Manager, and Chad Keller is the COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.