By Rod Smyth, RiverFront Investment Group Chief Investment Strategist

We believe U.S. long-term interest rates may have hit a multi-year low, perhaps even an all-time low.

If we are correct then bond portfolios and the bond portion of balanced portfolios require scrutiny in our view.

This is a bold statement, so let’s examine some of the main structural reasons that caused US long-term interest rates to fall to such low levels and seek to explain why we believe three of the structural forces that drove rates down are changing.

Paul Volker and the battle against inflation

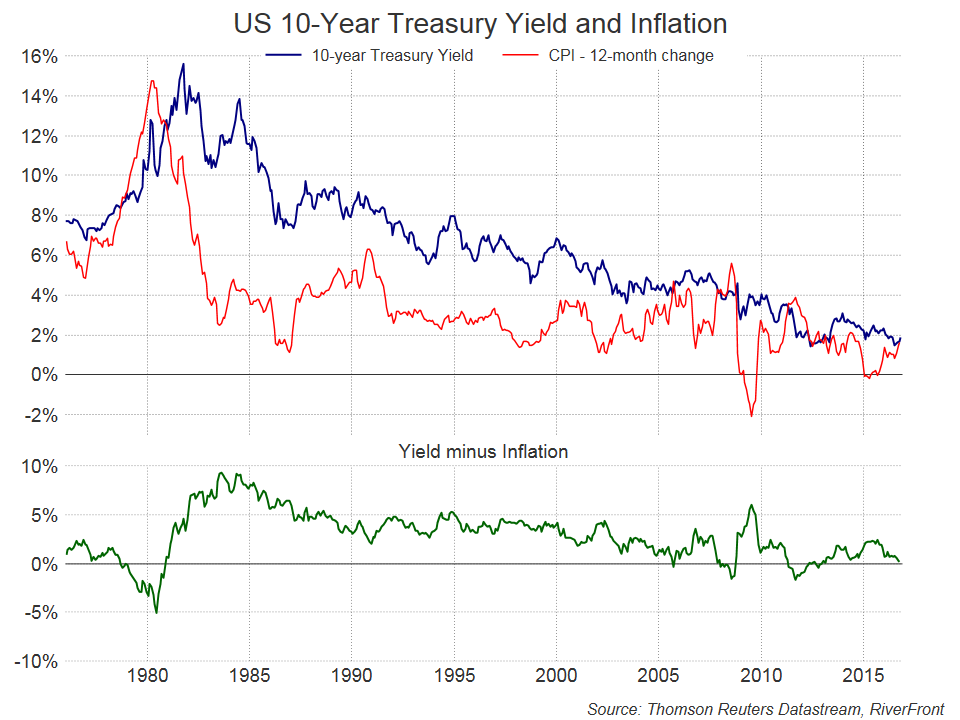

US 10-year Treasury note yields peaked in September 1981 at just over 15% (see chart below). Paul Volker took over as chairman of The Federal Reserve in August 1979 as inflation headed for double digit growth rates. He made reducing inflation the number one priority, implemented a policy of pushing short-term interest rates well above the level of inflation, and accepted the resulting back to back recessions of the early 1980s as an acceptable price.

As inflation fell, so did interest rates, but the legacy of Paul Volker was that 10-year bond yields remained well above the inflation rate for twenty five years beginning in 1982 (see lower clip on the chart below.

During the 2000s investors became much less concerned about inflation and the current Federal Reserve regime could hardly be more different.

Since 2009, both the Bernanke and Yellen Fed have had their primary focus on achieving higher growth and preventing deflation (falling prices).

For much of the last five years 10-year Treasury yields have been close to the level of inflation. Bond investors have not demanded a premium over the prevailing inflation rate.This suggests to us that complacency about inflation is pervasive and that bond investors have little or no protection should inflation accelerate.

Globalization and the labor “supply shock”

A series of events unfolded in the world economy during the last 25 years that profoundly changed the global labor market. For much of the post war period, the world’s most populace countries were closed economic systems, many embracing a communist economic model. Major economies such as India, the former Soviet Union and China all emerged from behind those closed economic systems during the 1990s and 2000s. Major free trade deals were negotiated, but perhaps the most significant single event was the admission of China into the World Trade Organization in 2001. This sudden and dramatic increase in the supply of global labor greatly reduced the negotiating power of workers in industries which compete in a global market; and, as many have argued, led to the election of President Trump. If the cost of globalization has been lost manufacturing jobs the benefit has been lower prices for all consumers, and thus persistently low levels of inflation as measured by goods prices. If the pendulum of US policy now swings away from free trade in order to protect US jobs, it follows that the risk is higher goods prices. As a result, we believe bond investors may once again require an ‘inflation premium’ i.e. 10-year rates that are above the prevailing inflation level.