Now, achieving the maximum payout upon expiration can be challenging, but by managing the trade during its life and booking profits, the butterfly can be re-set in another area that the portfolio manager feels the underlying might move towards. Real butterflies do not stay static, so why should option butterflies?

The next example combines the above put butterfly with our SPY stock portfolio in a 1:1 ratio. The stock with butterfly portfolio performs better than the collar portfolio right at the 208 strike at expiration. As mentioned previously, it does not provide absolute protection to the downside like the collar. Conversely, the fly does not cap upside participation like the collar and will provide for better upside capture ratios.

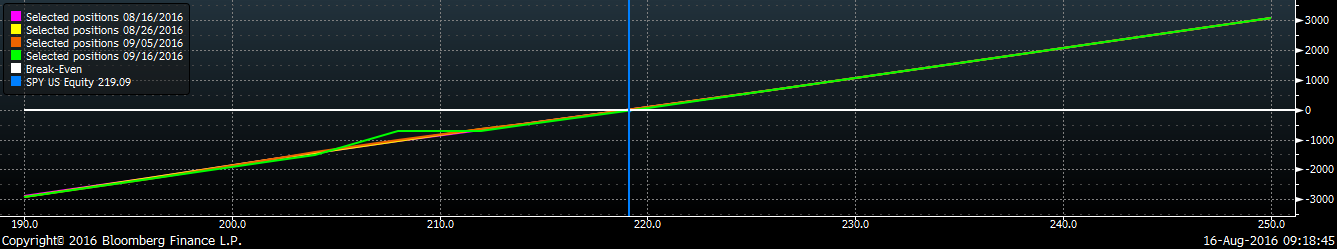

SPY SEP 204-208-212 Put Butterfly with SPY Profit and Loss Graph

Profit at Expiration:

| SPY Price: | 190 | 196 | 202 | 208 | 214 | 220 | 226 | 232 |

| Stock Only | $2,909 | $2,309 | $1,709 | $1,109 | $509 | $91 | $691 | $1,291 |

| Collar | 1,168 | 1,168 | 1,168 | 1,168 | 568 | 32 | 632 | 1,032 |

| Put Butterfly | 18 | 18 | 18 | 382 | 18 | 18 | 18 | 18 |

| Stock+Put Fly | 2,927 | 2,327 | 1,727 | 727 | 527 | 73 | 673 | 1,273 |

Basic option butterflys can be constructed using either calls or puts. More advanced butterfly variants can use both puts and calls and neither need to be equidistant in strike or even in maturity.

The bottom line – whether constructed using individual stocks, ETFs or other vehicles, a portfolio does not have to suffocate itself by attaching a collar, so go ahead and explore, spread your wings and fly!

Chris Hausman, CMT, is the Portfolio and Chief Technical Strategist at Swan Global Investments, a participant in the ETF Strategist Channel.

[related_stories]Disclosures:

Swan Global Investments is a SEC registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC. Disclosure notice and privacy policy.