MSCI ESG Select Indexes: The indexes are designed to maximize exposure to positive environmental, social and governance (ESG) factors while closely tracking the risk and return characteristics of the underlying market capitalization weighted indexes. Each index is constructed by selecting constituents from a Parent Index through an optimization process that aims to maximize exposure to ESG factors, subject to a target tracking error budget under certain constraints. The indexes are sector-diversified and target companies with high ESG ratings. Tobacco and Controversial Weapons companies are not eligible for inclusion in the indexes.

So while they both focus on the top tier ESG scoring companies, it appears the MSCI index has a bit more focus on tracking and limiting factor divergence from the base index, while STOXX has a bit more leeway in tracking the base index.

There are also differences, outside of the Global vs EAFE aspect, between the MSCI EAFE and STOXX Global 1800 that can affect the differentials as well. Here I have isolated the non-US exposure in the STOXX version and common sized it back to 100 to get a more apples-to-apples country comparison (showing top and bottom five differentials only):

Since STOXX is Global and MSCI is EAFE, the largest differential is going to be the Canada exposure. On the opposite end, the STOXX version has a comparative underweight to the Asian countries.

Stepping back a bit, here are some examples of the sector and industry deviations in ESGD compared to the base index as of month end:

- Sector Overweight: Industrials +1.62%

- Industry Overweight: Road & Rail +0.73%

- Sector Underweight: Consumer Staples -1.45%

- Industry Underweight: Tobacco -1.78% (which is completely expected since ESG investing excludes tobacco companies)

Emerging

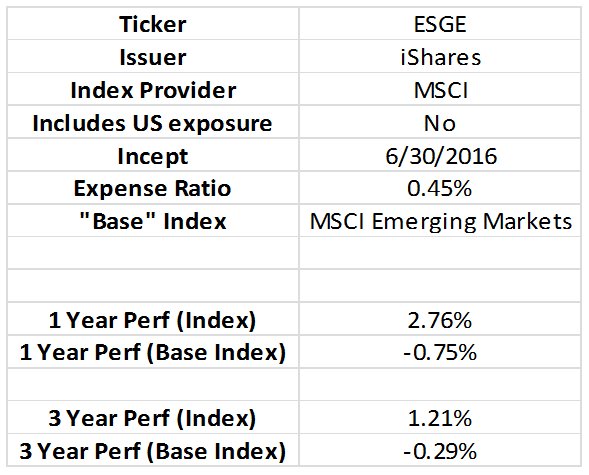

To fill out the international ESG ETF lineup is one Emerging Markets offering:

Although similar in design to its EAFE counterpart, the index has experienced a greater amount of positive dispersion from its base index over these periods. Here are some current exposure deviations:

- Sector Overweight: Financials 1.62%

- Industry Overweight: Banks 4.15%

- Sector Underweight: Consumer Staples -1.83%

- Industry Underweight: Food Products -1.07%

Summary

While the popularity of ESG investing in the US seems to be taking off given the increased AUM and number of tickers available, ETF investors can now apply similar ESG constraints to the international portion of their portfolios as well. While these new ETFs are in their infancy, the performance of the benchmark indices seems to show some positive price performance over their non-ESG counterparts. Combine this with the qualitative benefits of ESG investing and these new ETFs could soon find their way into portfolios.

Clayton Fresk is a Portfolio Manager at Stadion Money Management, a participant in the ETF Strategist Channel.

[related_stories]Disclosure Information

Past performance is no guarantee of future results. Investments are subject to risk and any investment strategy may lose money. The investment strategies presented are not appropriate for every investor and financial advisors should review the terms and conditions and risks involved. Some information contained herein was prepared by or obtained from sources that Stadion believes to be reliable. There is no assurance that any of the target prices or other forward-looking statements mentioned will be attained. Any market prices are only indications of market values and are subject to change. Any references to specific securities or market indexes are for informational purposes only. They are not intended as specific investment advice and should not be relied on for making investment decisions. The STOXX Global 1800 Index contains 600 European, 600 American and 600 Asia/Pacific region stocks represented by the STOXX Europe 600 Index, the STOXX North America 600 Index and the STOXX Asia/Pacific 600 Index. The MSCI EAFE (Europe, Australasia, and Far East) Index is a stock market index that is designed to measure the equity market performance of developed markets outside of the U.S. & Canada. The MSCI Emerging Markets Index is a float-adjusted market capitalization index that consists of indices in 21 emerging economies: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Morocco, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, and Turkey. One cannot invest directly in indexes, which are unmanaged and do not incur fees or charges. Founded in 1993, Stadion Money Management is a privately owned money management firm based near Athens, Georgia. Via its unique approach and suite of nontraditional strategies with a defensive bias, Stadion seeks to help investors—through advisors or retirement plans—protect and grow their “serious money.” Contact Stadion at 800-222-7636 or www.stadionmoney.com. SMM-082016-566