However, that simple analysis is grossly incorrect.

Why?

Because it fails to take into account the compounding impact of returns. Once all of the daily returns are linked together in a sequential fashion, it becomes painfully obvious that volatility can “drain” return. Moreover, the longer the time horizon, the worse the results.

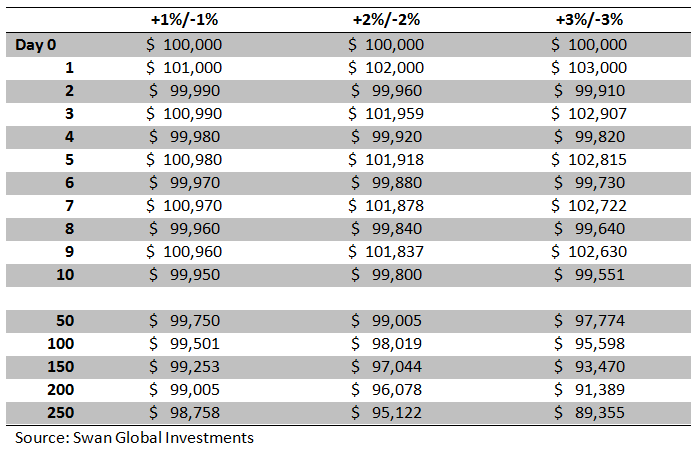

Starting with an initial theoretical investment of $100,000, after ten trading days the +1%/-1% investment is down $50 from its starting point. Meanwhile, the +3%/-3% leveraged investment is down almost $450 over that same time span. After 250 days, roughly the number of trading days in a year, the unleveraged investment has lost $1,242, or 1.24% of its initial value. However the triple-exposure option has lost $10,645, or 10.65% of its value.

Another way to interpret the above example is that avoiding losses is more important than capturing all the gains. In the above example, the size and count of the individual moves are equal on the upside and the downside. However, the final, aggregate results are tilted towards losses because losses have more of an impact than gains.

Of course in the real world investment returns are nowhere near as predictable as illustrated in this simple example. This case study was simply meant to illustrate the three general take-aways regarding volatility drain, namely:

- Volatility tends to have a detrimental impact on wealth

- The more volatile the investment, the bigger the impact

- The longer the time horizon, the bigger the impact

Certainly if one seeks to profit handsomely from short-term, high-conviction, speculative positions then leveraged ETFs might provide a good vehicle for doing so. Also, if we had an investment that always posted positive returns, never negative returns, volatility drain wouldn’t be much of a concern. However, as a long-term, buy-and-hold investment vehicle, leveraged ETFs carry risks that need to be fully understood to be appreciated. Alternatively, those investing for the long haul should be actively seeking out solutions that minimize volatility.

Swan Global Investments explores volatility drain and several other key mathematical principles in a new white paper called “Math Matters: Rethinking Investment Returns” by Micah Wakefield. Often overlooked or misunderstood, these key mathematical principles are essential to the success or failure of a long-term investment plan.

Swan Global Investments is a SEC registered investment advisor providing asset management services utilizing the Swan Defined Risk Strategy, allowing our clients to grow wealth while protecting capital. Please note that registration of the Advisor does not imply a certain level of skill or training. Swan Global Investments, LLC is affiliated with Swan Capital Management, LLC, Swan Global Management, LLC and Swan Wealth Management, LLC. Disclosure notice and privacy policy. 112-SGI-051016