Examples are Common

Last summer, Vanguard announced a series of index changes to four of their international equity ETFs. Specifically, Vanguard Emerging Markets Stock Index (NYSEArca: VWO) moved from the FTSE Emerging Index to the FTSE Emerging Markets All Cap China A Inclusion Index. The goal for the change was twofold: broader diversification and exposures to new markets. While both of these objectives are great investment ideas, if an investor was not monitoring the indexes being tracked by their investments, their portfolio exposures could have unexpectedly shifted.

Taking a look at each goal separately, we can see how changing the underlying index has an impact on the position’s exposure. First, the broader diversification was achieved by the inclusion of small cap equities. Before the inclusion, an investor may have been using a different fund to gain exposure to emerging markets small cap. If adjustments are not made, they may now have an overweight to this asset class without realizing it.

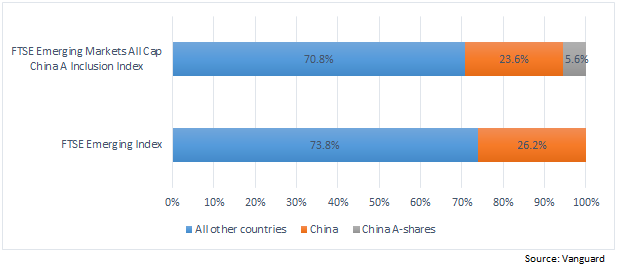

The second objective was providing exposure to new markets, mainly the China A share market. China A shares are equities which trade on the Shanghai and Shenzhen stock exchanges and were historically only available to domestic Chinese investors. It is a sizeable market with $6 trillion of market cap at the end of 2014 so their inclusion into the FTSE Index, and subsequent VWO Index change were significant events.

As can be seen above, the overall exposure to China within the ETF increased from 26% to almost 30% once the index transition is completed. Again, an investor who built their overall portfolio allocation utilizing exposure information from the old index may unknowingly be increasing their overall exposure to China. In this instance, an investor may look to complement VWO with an ETF like EGShares EM Core ex-China ETF (NYSEArca: XCEM) in order to get the overall China exposure back to the initial level.

Index-based investing is not a set-it and forget-it operation. It is important for not only retail investors, but also financial professionals to continuously monitor their investment vehicles to ensure appropriate exposure for their portfolios. Index changes, while infrequent, do occur and can have a dramatic impact on the exposure of a portfolio, depending on the level investment concentration.

Tyler Denholm, CFA, is Vice President – Investment Management and Research of TOPS/ValMark Advisers, a participant in the ETF Strategist Channel.

Important Disclosure: VWO and XCEM have been, may be and/or are currently held in several TOPS® Portfolios.

ValMark Advisers, Inc. (“ValMark”) is a federally registered investment adviser located in Akron, Ohio. ValMark and its representatives are in compliance with the current registration and notice filing requirements imposed upon federally covered investment advisers by those states in which ValMark maintains clients. For registration or additional information about ValMark, including its services and fees, a copy of our Form ADV is available upon request by contacting ValMark at 1-800-765-5201. This article provides commentary on current economic and market conditions and is not directly relevant to any particular client account. The information contained herein should not be construed as personalized investment advice or recommendations to buy or sell any security. There can be no assurance that the views and opinions expressed in this article will come to pass. Investing involves the risk of loss, including the loss of principal. Past performance is no guarantee of future results. Information contained herein is subject to change without notice and should not be considered as a solicitation to buy or sell any security. Indexes are unmanaged and cannot be directly invested in. TOPS® is a registered trademark of ValMark Advisers, Inc. Diversification does not prevent or guarantee against loss.