Note: This article appears on the ETFtrends.com Strategist Channel

By Chris Konstantinos

The Eurozone is not an easy story to believe in. Years after the onset of a credit crisis that continues to test cultural and economic resolve, the region is still the setting for some of the world’s ugliest news headlines. Terrorism, questions of solvency in the banking system, and a still-simmering migrant crisis are but a few items that have assaulted markets in recent months.

As value investors, we believe that sustained ugly headlines over time can create attractive entry points for assets. We tend to think that bad news eventually begets cheap prices, which begets outsized future returns. Riverfront’s Price Matters® asset allocation process is suggesting that, at current prices, developed international stocks (including the Eurozone) offer attractive potential 5- and 10-year forward returns, if history is any guide.

However, many investors are understandably asking us a different question: why do we believe that any of this value is set to be realized over the next 12 months? After all, valuation can be a poor timing tool, and being “early” in the portfolio management business is the same thing as being wrong. The purpose of today’s Weekly View is to lay out a transparent framework for some of the recent data that informs our preference for Eurozone stocks, as well as to show how we monitor the risks to our view.

1. Consumer Data – We believe Eurozone consumer is healthier than it appears

Despite the problematic news backdrop, data on the Eurozone consumer continues to be relatively solid, in our opinion. Eurozone retail sales volume and house prices have improved meaningfully since the Eurozone emerged from recession in mid-2012. Consumer confidence in a bellwether economy such as Germany (as measured by the GFK consumer climate survey) has also improved over the same time period, and, more recently, beat consensus this past Wednesday.

What is the cause of the resilient consumer?

We believe it is in part due to low energy prices, an improving employment picture, a less austere fiscal stance, and ultra-low interest rates across Europe that keep the price of financing low and the incentive for saving unattractive. This is important, as Riverfront’s current overweight to the Eurozone relative to both our strategic and composite benchmarks is primarily within domestically focused, consumer-facing sectors (consumer discretionary, consumer staples, telecom and utilities, and small-caps).

Lending and business confidence improving – early signs that QE is working?

It has become en vogue to question the efficacy of quantitative easing (QE), and in fact of central bankers in general. This is understandable, given the lack of inflation globally and concerns that unprecedented levels of monetary stimulus may lead to unforeseen long-term side effects. The best analogy for QE we can think of is that of a radical medical treatment; one that may save a patient’s life but can also cause unintended side-effects long after exit from the ICU.

So, for all the potential long-term side effects, is QE having any near-term positive effect at all? We believe an unbiased examination of the efficacy of the first 16 months of QE in the Eurozone should consider that data relating to lending and business confidence is improving. This suggests to us that the economy is improving despite a lack of inflation. Business confidence, as measured by the IFO Eurozone Economic Climate index, measured 118.9 in Q1 of 2016, up from its pre-QE announcement level of 102.3 in Q4 2014, and well above its long-term average of 102.1 from 2000-2015 (source: IFO Council, Datastream).

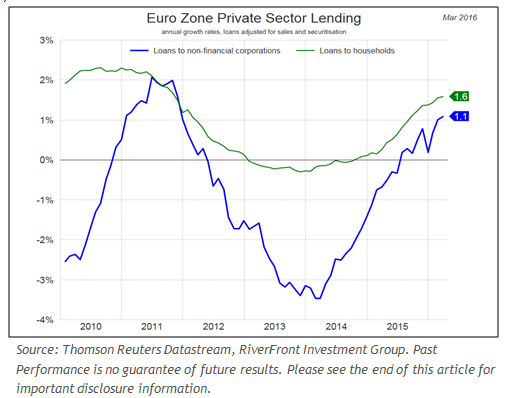

Despite well-publicized concerns about the effect of negative interest rates on the European banking system, we are seeing both the supply and demand for loans improving. Private sector lending to both companies and households continues to recover and grow (see chart below).

Corporate Earnings – Eurozone exporters and SMID-caps grew earnings faster than the S&P 500 last year, and we believe it can happen again

US investors looking at Eurozone equity performance could be excused for thinking that the Eurozone had a bad year in 2015. After all, many widely followed US-listed European ETFs had negative returns last year. However, those US dollar-denominated returns obscure the fact that most Eurozone stock markets had positive returns last year in local currency terms, before factoring in the euro currency’s (EUR) drop of over -11% relative to the US dollar (USD).

How did the Eurozone outperform the US last year in local terms, given all the negative news flow?

We believe it was in part due to Eurozone corporate earnings in certain sectors that outperformed their US peers, particularly in consumer and/or export-focused industries. We have calculated that a dividend-weighted basket of over one hundred large-cap, high quality Eurozone exporters (which we view as an adequate proxy for the securities that make up a meaningful part of Riverfront’s portfolio exposure in the region) experienced average earnings per share (EPS) growth of approximately +10% in calendar year 2015 (source: Factset Data Systems). This compares very favorably with an S&P 500 that barely managed to grow earnings at all last year, in our opinion.

Related: Housing Recovery – The Next Generation Joins In

Similarly, European small and mid-caps (SMID) also have had strong earnings profiles relative to US stocks. According to JP Morgan’s SMID Research team, 2015 actual EPS growth for Western European SMID companies was +10.4%, with approximately +17% growth expected in calendar year 2016, according to IBES consensus estimates (source: JP Morgan, April 4, 2016). Riverfront also has a meaningful tilt towards small and mid-cap Eurozone companies in our portfolios.

Can earnings momentum continue for quality Eurozone companies in 2016? While we expect lower outright growth in 2016, we are still cautiously optimistic given solid Eurozone economic data, a stable global economic growth outlook, some signs of China’s economy stabilizing and dovish stances from many of the world’s central banks, including the US Federal Reserve.

1. Monitoring bank and sovereign CDS spreads

One major risk factor in the Eurozone is the health of the banking system, as evidenced by the contingent convertible bond scare in January. One useful real-time financial stress indicator is to monitor credit default swaps (CDS) on major Eurozone financial institutions. CDS are derivatives that act as a type of insurance against corporate debt default – and, their publicly-traded nature make them a good real-time window into market-perceived credit stress. CDS spreads for Eurozone banks spiked meaningfully in January, indicating heightened risk, but generally not nearly to the same levels seen during the 2011-2012 crisis – despite some of their equity share prices revisiting crisis-era levels. Furthermore, most bank CDS are now back to much more normalized levels, in our opinion.