Recent IPO Performances Suggest VCs Are Getting Too Cocky

Despite the bubble-like valuations occurring in many venture-backed startups, there are some signs of dampening enthusiasm. Fundraising for venture capital firms fell off sharply in the third quarter, and surveys of VC confidence are at their lowest point since the very beginning of 2013.

A big part of this concern seems to be the increasing difficulty for VCs to achieve profitable exits on the public markets. As Figure 2 shows, IPO activity is down significantly this year, and that makes it harder for investors to get big paydays and sell their shares for several times what they paid for them.

Figure 2: The IPO Slowdown

Sources: Renaissance Capital

Just as important as the volume of IPOs are the circumstances surrounding them. While TWTR and LC in 2013 and 2014 were highly anticipated by investors, BOX took a much different path to its IPO. The cloud storage company was forced to IPO at a depressed valuation simply because it couldn’t attract any more private funding, and it needed an influx of cash to keep the lights on.

Increasingly, venture backed tech companies are following the path of Box and getting a lackluster reception on the public markets. IPO “down rounds”, where the company IPOs at a valuation below its last round of private financing, used to be fairly uncommon, but recently they’ve jumped to nearly 50% of tech IPOs.

With a record number of billion dollar startups coming up against an unenthusiastic IPO market, companies are going to struggle to make the case for high IPO valuations. VCs don’t care as their returns are already locked in, but founders and executives will be scrambling to price shares high so they don’t end up having to dilute their own stakes.

This means investors should be especially wary of accounting for upcoming IPOs in the near future. These companies haven’t faced much public scrutiny, and they’ll be getting creative in the ways they try to inflate their profitability.

Eventually, the bubble is going to burst, VC money will dry up, and we’ll stop seeing as many risky and overhyped IPOs. Until that point, investors need to be on their guard.

Alternatives To Venture Capital

The good news is that startups shouldn’t be left without any access to capital after the VC bubble bursts. Increasingly, we’re seeing successful young companies find alternatives to the traditional venture-backed financing model. When they can afford it, some startups are bootstrapping, building their business without outside financing as much as possible.

In addition, business development corporations (BDC’s) have taken off in recent years, providing loans to small businesses that fall in between the high-growth favored by VCs and the more established companies that can get financing from big banks.

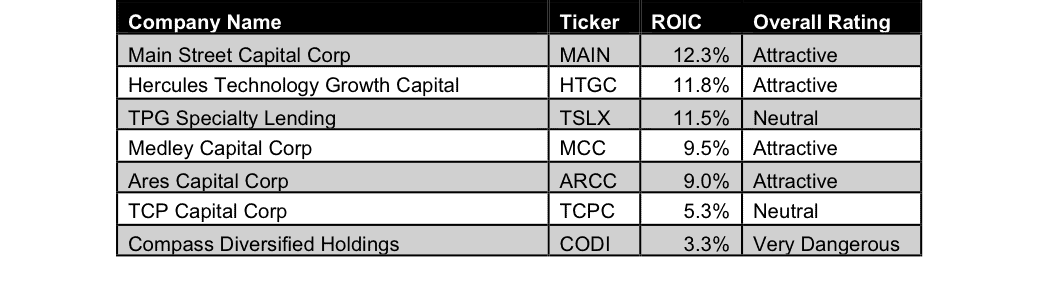

As Figure 3 shows, many BDC’s earn solid returns on capital by investing in stable, cash-flow generating businesses rather than chasing after unicorns.

Figure 3: ROICs For Business Development Corporations

Sources: New Constructs, LLC and company filings

For too many years, venture capitalists have held the mindset that the ultimate goal is a lucrative exit from an IPO. With that option starting to dry up, maybe we’ll start seeing a shift in attitudes and more young companies being pushed to create sustainable business models and cash flows rather than just focusing so heavily on customer acquisition. Not only would this be better for the overall economy, it would lead to companies being much more attractive investments when they hold their IPOs.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, style, or theme.

Click here to download a PDF of this report.

Photo Credit Anthony Quintano (Flickr)