A look at precious metals as we end the week.

- Precious metals should be primary beneficiaries, from this morning’s news of the latest rate and reserve ratio cut from the PBOC, on the back of the ECB’s commitment yesterday to add more liquidity

- From Morgan Stanley’s FX pulse: “Not fighting the ECB. The ECB has made it clear that it wants a lower EUR, and we will not fight it”

- The US Dollar has increased as other countries continue to add liquidity, weakening their currencies, but despite the stronger US dollar, gold continues to do well

- YTD, gold is near unch’d in USD ($1,184 at end of 2014), in terms of the Euro currency, gold is up over 8%. YTD the US dollar index is up about 7%

- Stocks up too on more global liquidity and reduced Fed tightening expectations but higher stocks are also taking away some of the gold luster

The foundation for precious metals got a strong boost this week due to the ECB’s greater liquidity commitment and the latest rate cut from the PBOC. Global central banks appear to be accelerating the currency war trend, improving the foundation forming in the precious metals. The key thing for investors to remember, central banks are not cutting rates because they want to, they are because they are fighting off significantly weakening economies and deflationary forces. Initial stock market gains may be elusive but the longer-term foundation building for precious metals is strengthening. Some notable bullish precious metals developments:

- Gold futures open interest is up about 27% YTD. Not since 1995 has the gold price declined on an annual basis when gold futures open interest was up so much. The indication is dealers are getting lifted out of gold and hedging in futures

- Gold futures remain in backwardation, potentially for the longest period in CME/Comex history

- Gold ETF flows in Oct. are on pace for the best month since Jan., up 1% so far on the month, about 500,000 ounces

- Silver is running neck and neck with cotton as the best performing BCOM commodity in 2015, both up about 2%

- Many precious metals demand indicators are on record pace: Shanghai Gold Exchange withdrawals, India silver imports, silver coin sales

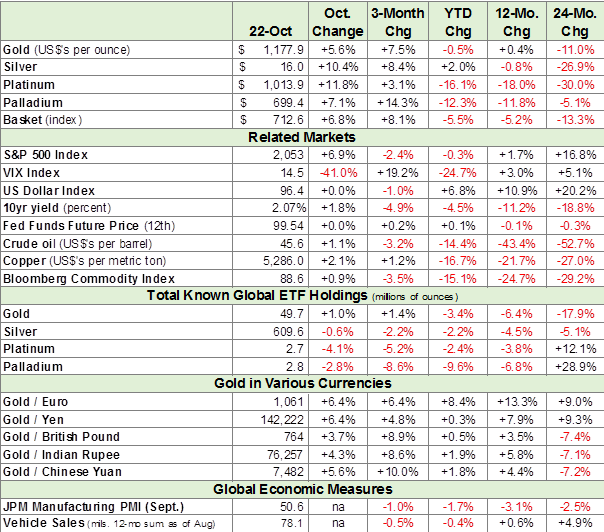

Data Table from this am: