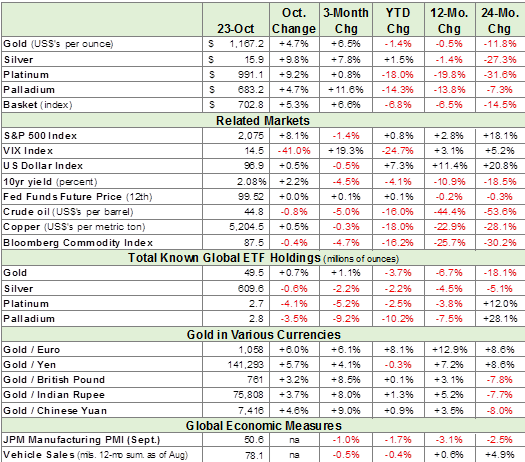

As we near the end of October:

- Gold is up about 5% in Oct. but the S&P 500 is up 8%, pressuring gold

- 2015 has been a good year for gold so far, in the Euro currency: +8% YTD

- Gold remains resilient in USD terms (-1.4% YTD) despite the strong US dollar (+7.3% YTD, USD index) and outflows in gold ETFs (gold ETF holdings down 3.7% YTD)

- Gold futures open interest (OI) continues to jump (+27% YTD) indicating strong buying. Not since 1995 has the annual gold price declined with OI up so much

- Gold futures remain in backwardation (1st thru the 3rd) for the longest period in our database (1995), indicating strong demand

- Shanghai Gold Exchange withdrawals remain on record pace

- Silver is the best performing precious metal in 2015 (+1.5%) and second best in the BCOM (India silver imports and global coin sales are on record pace)

- The gold silver ratio remains elevated at 73 last but it has declined from the 2015 high near 80 in late August

- The elevated gold silver ratio reflects slack global industrial demand as evidenced in the -18% and -14% YTD declines in platinum and palladium

- The Fed tightening expectations trend remains towards delay and reduce, 25bps not until April, in futures… sound similar, next year? Cubs fans?

Data tables below

Precious metals got a boost at the beginning of October on the back of the weaker than expected September unemployment report. The bad news for precious metals, is the stock market rallied substantially, on diminished Fed tightening expectations, stealing some of the lustre from gold. Up 8.1% so far in October, the S&P 500 is on pace for the best month since October 2011, which was the rebound from the US debt downgrade and about the same time gold peaked at $1,900/oz. Early next month, the US government risks shutdown again. Last week, the ECB signaled further stimulus and the PBOC again cut rates and bank reserve requirements. Global vehicle sales have been stagnant in 2015 and may have the first annual decline since 2008 (current pace is -0.6%). But 2008 was a plunge in auto sales (-6.0%) and platinum and palladium prices have already plunged in 2015, to very attractive levels. In September, platinum reached the lowest price relative to gold in the history of our database (since 1970). Central banks are rushing to add liquidity in the midst of slack demand and deflating markets; BCOM down 16% YTD for the 5th consecutive annual decline. In the US, despite improving employment indicators, the trends in retail sales and industrial production are near recessionary levels: YOY retail sales are down 45% and YOY industrial production is down 90% from year ago levels. The latest PPI and CPI YOY levels were negative, indicating we are no longer in a disinflation environment. Lower levels from here would be deflation. The precious metals are setting up for a decent rally into the yearend. A continued rally in the stock market would likely be a primary pressure factor, notably for gold.