Our research has shown that there is little persistence of active managers generating excess returns in the most efficient markets; therefore we would recommend a higher allocation to Fundamental Indexing for their alpha potential. In the less efficient markets (Emerging Markets), we would recommend a higher allocation to active managers with strong downside capture ratios. Depending upon the market environment, and/or personal views, advisors can adjust the allocations.

ETF Trends: In your paper “Why Fundamentals – Why Now?” you make the case that given where we are in the market cycle, now could be an opportune time to consider fundamentally-weighted strategies. Does the recent market environment change your point of view?

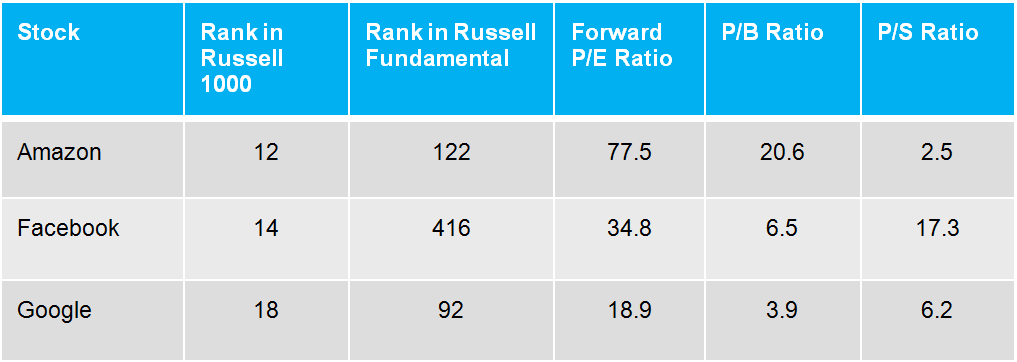

Davidow: In our paper, we make the case that in the early phases of a bull market “a rising tide lifts all ships.” As the bull market matures, we believe that savvy investors pay more attention to strong companies with sound fundamentals. Many of the popular stocks like Amazon, Facebook and Google have large weights in the market-cap indexes without regard to their valuations.

We believe that fundamental indexing makes sense given the ‘stretched’ valuations and recent market uncertainty. We believe that fundamentals matter.

ETF Trends: Fundamentally-weighted indexes have been around for a long time. Why do you think they are taking off now?

Davidow: A number of factors have led to the increased interest in Fundamental Index strategies. The most important is the fact that these strategies have been battle-tested. Unlike some of the newer strategic beta strategies, the RAFI Fundamental Index strategies are celebrating their 10-year anniversary, and the ‘live’ data has matched the simulated returns presented in the original research. Another important factor is education. The industry has done a better job educating advisors and investors about the merits of these strategies.

ETF Trends: You’re out in the field, talking to clients and advisors all the time. What are they asking you about smart beta strategies?

Davidow: In the early days, the discussions focused on “Do these strategies work?” Now the discussions have become “How do I distinguish amongst the strategies?” and “How do I use them to build portfolios?”