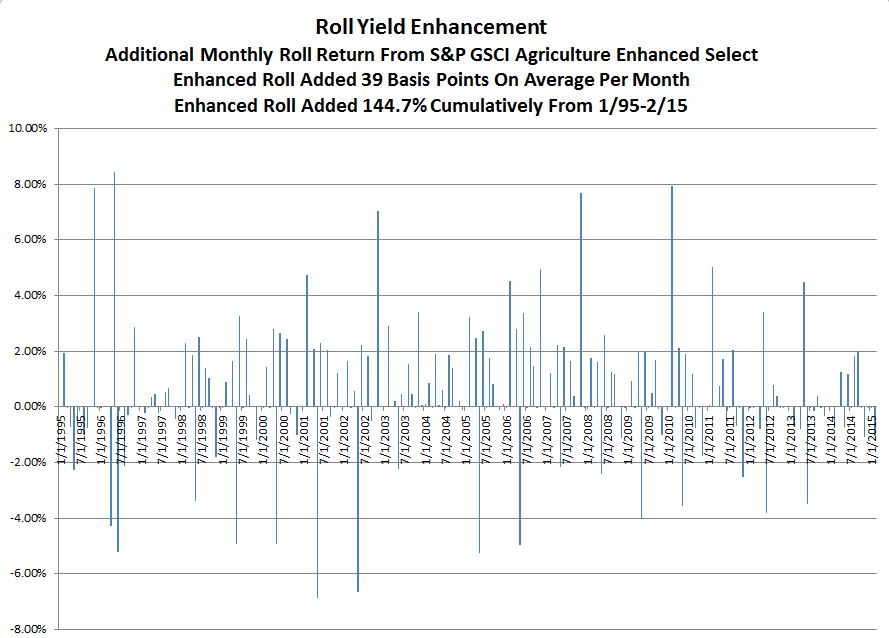

However, when the rolling of agriculture futures contracts is employed strategically according to seasonal adjustments, it has been significantly positive. The chart below shows the difference in monthly roll yield (excess return – spot) of the S&P GSCI Agriculture Enhanced Select less the S&P GSCI Agriculture Select. On average, the enhanced roll added 39 basis points per month. Cumulatively, this has compounded to add 144.7% from Jan 1995 – Feb 2015.

If Jacks is correct in pointing out the transition from fixed capital accumulation to a consumption-based economy, and suburbanization is tentatively beginning, then it may be likely to see an increase in demand for goods “to be grown” and an inflection in long-run trend. The sub-trend pricing for goods “in the ground” could be the formation of a new cycle in the medium run. So if it is time for agriculture, an enhanced roll might make sense.

This article was written by Jodie Gunzberg, global head of commodities, S&P Down Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com