Even if you are in command of economy with a positive current account balance, such as the countries on the right hand side of the table, only under certain conditions can one consider a strategy of currency debasement. Inflation remains a risk and it would be incredibly helpful, for example, to have a collapse in energy and food prices before you start.

Race to debase

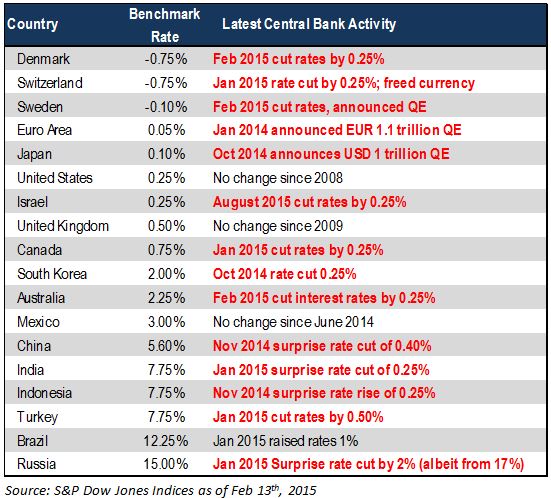

Well, you can see the temptation. Unfortunately, you may not be the only one to have thought of this:

So everybody’s doing it?

Therein lies the problem. We can’t all debase our currencies; it doesn’t work if everybody does it. But not quite everybody is. The U.S. looks to be moving towards a rate increase in the next stage of its cycle, and it is no coincidence that the U.S. dollar strengthened more than any other major currency in 2014. And that is why there is a renewed interest among U.S. investors in currency hedging their international exposures. The stimulus and easing packages announced by central banks and governments across the world recently may well prove to deliver the anticipated benefit to local stock markets and economies. But if a central component to their success is a depreciating currency, it makes sense to hedge it out. In the meantime, versions of the conundrum facing Atlantis are being played out across the globe; not everyone can be a winner.

This article was written by Tim Edwards, direct, index investment strategy, S&P Dow Jones Indices.

© S&P Dow Jones Indices LLC 2013. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to SPDJI. This material is reproduced with the prior written consent of SPDJI. For more information on SPDJI, visit http://www.spdji.com