Last Saturday’s Wall Street Journal carried an excellent list of “16 Rules for Investors to Live By.” I was particularly impressed by rule #1: “All past market crashes are viewed as opportunities, but all future market crashes are viewed as risks.” Serendipitously, the 16 rules followed close on the heels of our latest white paper, which deals with many of the same concepts. In particular, volatility rises when markets crash, and volatility and opportunity are closely related.

It’s comparatively well-understood that changes in volatility are negatively correlated with returns; it’s less well-known that higher levels of volatility are also negatively correlated with returns. Below we’ve charted the average monthly change in the Dow Jones Industrial Average against its concurrent monthly volatility. Although there’s no relationship to speak of in the middle quintiles, the lowest quintile of volatility shows the highest average returns, and the highest quintile of volatility shows the lowest average returns.

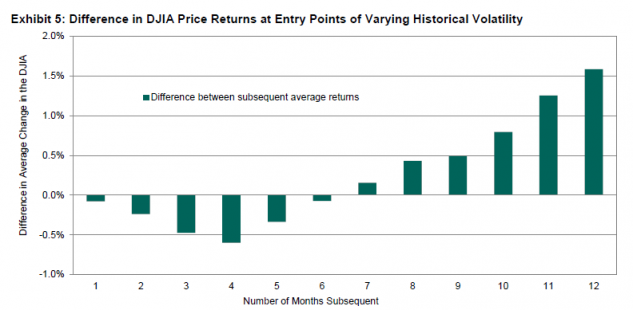

These data make the connection between volatility and return on a short-term basis. But is there opportunity in high volatility? For investors willing and able to look beyond a one-month holding period, perhaps so; if volatility indicates distress for existing investments, it may signal an attractive entry point for new ones. We tested this hypothesis by calculating returns for holding periods of various lengths, conditioned on whether volatility is above or below its long-run average when the position is initiated. Given the relationship between high volatility and low returns, it’s not surprising that investments made during periods of below-average volatility outperform over short holding periods (up to about 6 months). After that, however, fortune favors the bold: