As you, dear patient reader, have no doubt noticed, volatility is back. The VIX® has reached levels not seen since the peak of the Eurozone crisis over two years ago. The exact reasons might be debatable, but either way October is living up to its perennial reputation as the cruelest month for equities.

Source: CBOE

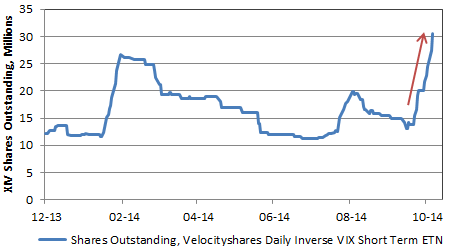

Each time in recent history that the VIX closed above 20, it has rapidly collapsed (see above). And duly following the principle of induction, spikes in volatility are now interpreted as a selling opportunity (in respect of the VIX) by the average punter. One example of this demand: the largest exchange-traded product providing a short exposure to VIX futures has doubled in shares outstanding in the last few days:

Source: Bloomberg, as of Oct 15th

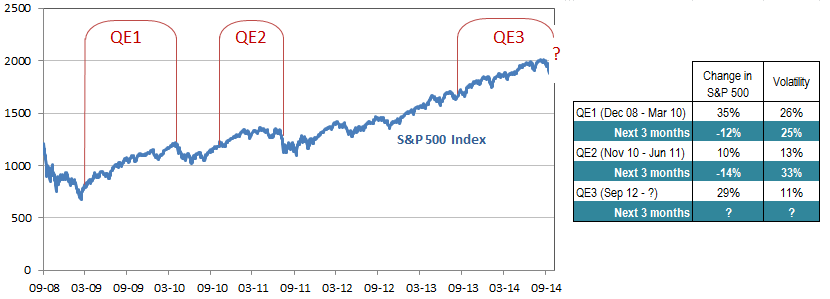

Yet volatility levels are not guaranteed to fall. If the U.S. Federal Reserve’s largess was indeed the primary cause of the suppressed levels of volatility seen in the first three quarters of this year, the seat-belts are off. QE3 is expected to end in the next few weeks; history was not kind to equity investors in the periods immediately following the last two rounds:

Source: S&P Dow Jones Indices