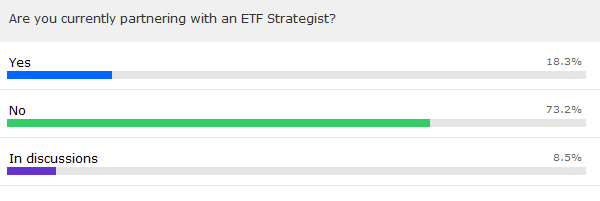

Consequently, it is not surprising that many advisors have not partnered with an ETF Strategist.

Nevertheless, the ETF managed portfolios space is poised to grow as more advisors adopt the strategies. As demand for financial services expand, partially aided by aging demographics among the group of Baby Boomers, and innovation in product development accelerates, there is greater need for assistance to optimize the potential benefits of the ETF investments.

Nevertheless, the ETF managed portfolios space is poised to grow as more advisors adopt the strategies. As demand for financial services expand, partially aided by aging demographics among the group of Baby Boomers, and innovation in product development accelerates, there is greater need for assistance to optimize the potential benefits of the ETF investments.

Through a partnership with an ETF Strategist, advisors can enhance their practices by freeing up more time to manage client relationships, utilizing tactical asset allocation tools, shifting out of traditional asset classes in increasingly volatile market conditions, and increasing focus on delivering a more personalized performance that caters to investors’ outlook.

Advisors who have decided on partnering with ETF Strategists don’t typically hand over all investment decisions. Many have just outsourced a portion of their client portfolios to an ETF Strategist, with the most common allocation coming in at around 20% to 40% of client portfolios.

Financial advisors who are interested in learning more about ETF managed portfolios and ETF strategists can listen to the webcast here on demand.