The nearly $3.1 billion of outflows from corporate ETFs represented 3.1% of assets and was primarily concentrated in high yield. Year to date, $701.8 million of inflows into convertibles equate to nearly 35% of assets.

The closely-followed outflows from high yield ETFs this year, which amounted to over $3.1 billion year to date or 6.3% of assets, concerns investors. Money continued to flow into investment grade funds, which has taken in over $21.1 billion for the year. This rotation is notable since the backdrop for credit remains favorable, even with the possible acceleration of Fed rate hikes. Thus, it appears that the sell-off is more driven by technicals and sentiment rather than deterioration in credit fundamentals.

With fundamental credit still solid, can we take advantage of any possible dislocations in the high yield market?

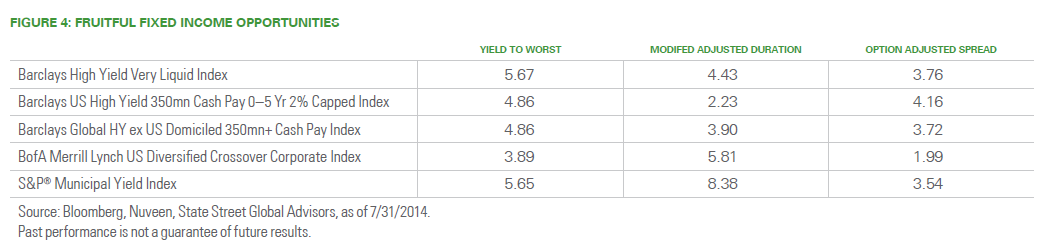

The first opportunity is to recognize that even with the recent sell-off spreads remain depressed relative to historical levels. While there’s a strong case to be made for spreads to touch their all-time lows, let’s assume that the shift in sentiment trumps any fundamental case that still exists for the asset class, and spreads could creep higher going forward. We can explore other investment choices that balance the need for current income without the fears of irrational exuberance that seem to accompany the high yield market.

Additionally, junk bonds outside of the US are increasingly looking like a solid investment option. The accommodative monetary policy from the European Central Bank—as the Federal Reserve looks to be diverging from the crowd with tightening policy—will likely became a greater tailwind for European credit relative to the US. Due to years of concern with the Euro-zone, Euro corporate spreads are far less compressed relative to their US counterparts. At the same time, the Euro-zone may be at the beginning stage of a business cycle recovery that we’ve already been experiencing in the US. International high yield also offers investors a way to move up in credit quality relative to the US.

Another approach would be to move up in credit quality from high yield to crossover bonds. The intersection of BB/ BBB1 avoids the low yields from higher quality bonds, but does not expose investors to the most overpriced segment of the market: CCCs. For investors looking to sell high yield, crossover bonds offer a new favorable investment option. At the same time, stepping into crossovers brings an investor access to the credit market’s sweet spot, with the highest Sharpe Ratios2 over the long run.

Lastly, high yield municipal bonds offer a favorable income stream, but have lower fears of overextension than high yield corporates. High yield municipals offer a clear yield advantage relative to their corporate debt, and provide diversification benefits that are getting harder and harder to find across fixed income markets. While the municipal market has its fair share of the walking wounded, most high yield municipals are revenue bonds issued for specific purposes. One way to potentially mitigate idiosyncratic risk3 from issuers in the municipal space would be to maintain a higher quality bias.

LOOKING AHEAD

The trends that are beginning to emerge may permeate across markets for some time, absent an external shock. Driven by an evolving economic growth outlook, a rotation from European assets to emerging markets investments has started to unfold. US small caps and high yield bonds are also seeing sell-offs due to concerns about stretched valuations. All of this points to investors getting slightly more cautious about where to put capital, but still largely confident that in a generally low inflation environment, with improving economic growth, companies can continue to deliver strong earnings (as evidenced by favorable results in the second quarter). Fixed income investors can find opportunities with familiar income streams, but potentially more attractive total returns.

Implementation Ideas

- SPDR Barclays International High Yield Bond ETF (IJNK)

- SPDR BofA Merrill Lynch Crossover Corporate Bond ETF (XOVR)

- SPDR Nuveen S&P High Yield Municipal Bond ETF (HYMB)

David Mazza is vice president and head of ETF investment strategy, Americas, for State Street Global Advisors, which manages the SPDR ETFs.